Out of Thin Air – Where The Stimulus Money Comes From

I was interviewed recently for The Banner, the school newspaper at California Baptist University, in an article entitled, Covid-19 Relief Could Have Long-Term Effects on U.S. Economy. The main question I was asked is: “Where does the stimulus money come from? Good question; one that I don’t think many people really understand – or worry about, as long as they get their stimulus check.

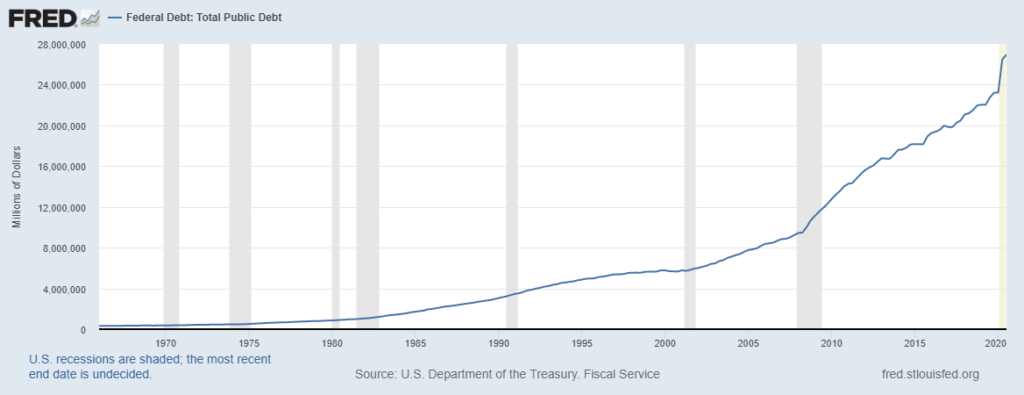

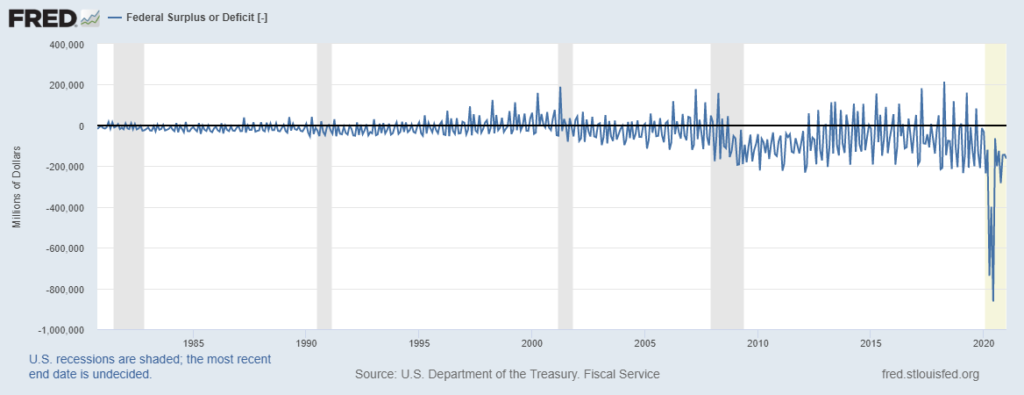

The federal debt has swollen to over $27 trillion. The federal deficit was $3.1 trillion in fiscal 2020. President Biden is asking for a $1.9 trillion dollar relief package. Where indeed does the money for all of this come from?

There are generally only three sources for federal spending: (1) tax revenue; (2) borrowing; and (3) printing money. The first, tax revenue, is fairly obvious. The federal government has the ability to tax – and taxing is something they are fairly good at. We often say that government debt is backed by “the full faith and credit of the Unites States Government.” What gives that backing credibility is the U.S. government’s ability to tax its citizenry. But there is a limit to how much the government can tax, of course. Unfortunately, I don’t believe policy makers have fully realized what that limit is.

The second source of spending is federal debt. As I said earlier, the federal debt is over $27 trillion. I have included a chart in the Charts for Review and Thought below showing the level of debt. As you can see, the debt has increased at an exponential rate since the 1980s, and the rate of that expansion has exploded in the last couple of years due largely to the pandemic.

The third source is the printing of money. When we say the government prints money, we don’t mean the dollar bills and coins that we carry around in our pockets. Yes, the government does print currency and mint coins; but the really big “printing of money” is done electronically and is done by the Federal Reserve (the “Fed”). The Fed has the ability to inject money (print money) into the banking system by buying government bonds with the push of a button. A new phenomenon that has resulted from the pandemic is the Fed lending directly to businesses, a new policy adopted by the Fed in an attempt to help businesses during the pandemic.

So, the question is: “Can this cycle of debt and the printing of money go on forever?” Most economists don’t believe so. Many, but not all, economists believe that the debt eventually has to be paid back. That could be a problem. Federal Reserve Chairman Jerome Powell “told reporters that the U.S. has not been on a ‘sustainable’ fiscal path for some time, noting the nation’s debt is growing faster than the economy” (Sergent et al, 2021).

Furthermore, many economists, though not all, believe that “too much money chasing too few goods”, which is what happens when you print too much money without increasing the production of goods and services, will only cause inflation. As the renowned economist Milton Friedman said: “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” (Friedman, 1970). Federal Reserve critic and former Republican presidential candidate Ron Paul told USA TODAY: “What we’re working with now is fake money, a fake measuring rod. It is unbelievable” (Schrotenboer, 2020).

One final note is to consider the effect on future generations if the debt is not paid back in our generation and/or inflation escalates to high levels. As to the debt, if the current generation doesn’t pay the debt, it will become a burden of future generations. As for inflation, it is in essence a tax on future generations. Neither situation is good.

While the pandemic has wrought a heavy toll on the global economy – not just the U.S. economy – the way out of this crisis it to help businesses rebuild so that they can provide the much-needed infrastructure and increase in the production of goods and services that lead to economic growth and productivity. While some government stimulus may be necessary in the short run because of the devastating effects of the pandemic, it is an open question as to how much stimulus is too much. We have probably already reached the level of too much stimulus. Going forward, it will be imperative to help businesses get back on their feet. I will explore this idea further in an upcoming paper I am writing on a new economic concept I call The Value Creation Theory of the Economy, or Intrinsinomics, for short. I have made two presentations on this concept at the International Leadership Association’s (ILA) annual conferences in the past two years. You can access these presentations here.

References

Friedman, M. (1970). Counter-Revolution in Monetary Theory. Wincott Memorial Lecture, Institute of Economic Affairs.

Schrotenboer, B. (2020). US Is Printing Money To Help Save The Economy From Covid-19 Crisis, But Some Wonder How Far It Can go. USA Today.

Sergent, J., et al. (2021). New Covid-19 Stimulus Bill Is Half of March’s. How Else It Differs. El Paso Times. El Paso, Texas.

Economic and Investment Highlights

Last Week

China became the top nation for new foreign direct investment, overtaking the U.S.

Fewer borrowers are resuming making their mortgage payments.

Options trading is continuing this year at an enormous rate, following records set in 2020.

Longtime talk-show host, Larry King, died from complications of Covid-19 at the age of 87.

Yellen was confirmed as Treasury Secretary.

The House sent the article of impeachment against Trump to the Senate.

GE booked $4.4 billion in fourth quarter cash flow, beating its own projection and ending 2020 without burning cash. This was a year ahead of schedule.

GameStop, AMC, and Blackberry, among others, have upended Wall Street in trading.

The Fed kept its easy money policies in place, citing concerns that business activity has softened amid a resurgence in the pandemic.

Apple had its most profitable quarter ever at the end of 2020 with quarterly revenue exceeding $100 billion.

The U.S. economy shrank in 2020 for the first time since the financial crisis, but grew rapidly in the fourth quarter. It was the worst year since the 1940s.

U.S. household income rose in December as new government stimulus aid kicked in.

The Dow, the S&P 500, and the Nasdaq all fell for the week. The Dow was down 3.3%; the S&P 500 was down 3.31%; and the Nasdaq was down 3.5%. The 10-year treasury yield ended the week at 1.090%. Gold closed at $1,847.30 for the week. Oil closed at $52.20 for the week.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The models below may not capture the impact of COVID-19 beyond their impact on GDP source data and relevant economic reports that have already been released. They may not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the models.

Note: The comments that follow are derived from the economic indicators referenced in the Resources section of this newsletter and other sources in this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) had been trending up for several weeks from having dipped in 2019. Recently with the advent of the economic collapse, the index crashed. It has now been generally trending down again, but fluctuating within a narrow band. This is a slightly positive indicator for the economy on a short-term basis.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 7.4 percent. This reading agrees with the ALS model assessment of an improving short-term economic environment.

The New York Fed Staff Nowcast stands at 6.48 percent for 2021:Q1.

The Chicago Fed National Activity Index (CFNAI) showed an increase in economic activity in October. The Chicago Fed National Activity Index (CFNAI) was +0.52 in December, up from +0.31 in November.

All told, these short-term economic indicators are a mixed analysis for the economy, at least on a short-term basis.

Expectations that stock prices will rise over the next six months is now at 37.7% in a recent AAII Sentiment Survey. The historical average is 38.0% for the survey. 24.0% of the investors in the survey described their short-term outlook as neutral and 38.3% were bearish. Please see the AAII Sentiment Survey for the complete results.

The latest Gross Output (GO) reading (December 22, 2020) showed that Gross Output rose significantly in the 3rd quarter 2020.

Advisor Perspectives publishes a monthly market valuation update.

Advisor Perspectives has market valuation and other useful and interesting investment information at this website.

Fourth Quarter 2020 Survey of Professional Forecasters

[Release Date: November 16, 2020] The outlook for real GDP growth in the next few quarters looks weaker now than it did three months ago, according to 37 forecasters surveyed by the Federal Reserve Bank of Philadelphia. The forecasters predict the economy will expand at an annual rate of 4.0 percent this quarter, lower than the prediction of 5.8 percent from the previous survey. On an annual-average over annual-average basis, the forecasters expect real GDP to decrease 3.5 percent this year but to recover and grow at an annual rate of between 2.1 percent to 4.0 percent over each of the following three years.

A downward revision to the projection for the unemployment rate accompanies the outlook for growth. The forecasters predict unemployment will decrease from a projected 7.0 percent this quarter to 5.8 percent in the fourth quarter of 2021. The prediction for the current-quarter unemployment rate is 2.5 percentage points lower than that of the last survey. On an annual-average basis, the panelists predict the unemployment rate will decline from a projected 8.2 percent in 2020 to 4.6 percent in 2023.

On the employment front, the forecasters expect job gains in the current quarter at a rate of 689,800 per month. The employment projections for the current and the following three quarters show upward revisions from those of the previous survey. The projections for the annual-average level of nonfarm payroll employment suggest job losses at a monthly rate of 718,000 in 2020 and job gains at a monthly rate of 321,600 in 2021. (These annual-average estimates are computed as the year-to-year change in the annual-average level of nonfarm payroll employment, converted to a monthly rate.)

The next survey will be released on February 12, 2021

NABE Surveys

NABE Business Conditions Survey – January 2021

COMMENTS: “Results of the January NABE Business Conditions Survey show that conditions continued to improve during the last quarter of 2020 after the collapse experienced during the first half of last year,” said NABE President Manuel Balmaseda, CBE, chief economist, CEMEX. “Momentum has continued to build, and survey respondents seem much more positive about the future today than in October. Furthermore, expectations regarding GDP growth continue to improve, with 69% of respondents expecting growth in inflation-adjusted gross domestic product over the next year of 3.0% or higher, compared to just 59% in the October survey.”

HIGHLIGHTS

• Respondents’ views continue to coalesce around an expansionary outlook for growth in inflation-adjusted gross domestic product (real GDP), with 69% of panelists expecting GDP to expand by 3.0% or more. Just 2% of respondents anticipate negative growth over the year ahead (ending in Q4 2021). This compares favorably with results of the July 2020 survey in which nearly 40% of respondents anticipated shrinking output growth over the four quarters ending in Q2 2021, as well as with results in the October 2020 survey in which roughly 10% viewed negative growth as most likely.

• Just over half (51%) of respondents report that sales at their firms increased in Q4 2020, nearly matching the 52% in the October survey who reported an increase in Q3. The share that reports a decrease in sales declined from 20% in October to 13% in the January survey. As a result, the Net Rising Index (NRI) for sales—the percentage of panelists reporting rising sales minus the percentage reporting falling sales—climbed to a two-year high of 38, up from 33 in October and -14 in July. The forward-looking NRI for anticipated sales over the next three months continues to rise, from 31 in October to 38—the highest reading since the April 2019 survey.

• Profit margins reversed course in Q4, with more respondents reporting profits rising than falling. The NRI for profit margins increased 18 points to 14 from -4 in October. The share of respondents reporting rising profit margins increased from 21% in October to 30% in January, while the percentage reporting falling margins declined 9 percentage points— from 25% in October to 16% in January. Of the survey’s four sectors, the goods-producing sector experienced the largest jump in the NRI for profit margins, a 56-point swing from -18 in October to 38 in January.

• The NRI for prices charged is 15, having surged 14 points from October. NRIs by sector, however, vary significantly. The January NRI for goods-producing firms is 71, after registering 21 in October. The index for finance, insurance, and real estate (FIRE) sector firms remains negative at -12, up from -19 in October. Between these extremes are the NRI for service sector firms, with a reading of 8, up from 3 in October, and the NRI of 25 for the transportation, utilities, information, communications (TUIC) sector. The share of respondents expecting price increases in the next three months continues to rise—35% in January compared to 26% in October—resulting in an NRI of 30. Five percent of panelists anticipate falling prices in the next three months.

• The NRI for materials costs accelerated to an NRI of 28, the highest reading since April 2019. All sectors registered positive NRIs, led by goods-producers at 62. The NRI for expected costs rose significantly, from 8 to 34, after having been as low as -21 in April 2020.

• The NRI for wages and salaries rebounded to 19 in the January survey, a clear continuation in the recovery from the depths of the COVID-19 slump during 2020. The upward movement in the index resulted from an increase in the share of respondents citing rising wages—to 28% from 17% in October—and a decrease to 9% from 13% in the share reporting falling wages.

• The NRI for employment rose to 7—the highest reading since October 2019, and the first positive value since April 2020. The share of respondents citing decreased hiring activity fell from 27% to 13%, while 19% report employment increased at their firms compared to 9% in the October survey. All sectors have positive NRIs. The NRI for the services sector rose from -5 in October to 6. The largest increase is in the goods-producing sector, up 54 points to 8 in January. Respondents remain optimistic regarding the near-term outlook for employment, as the forward-looking NRI rose to 21 from 1 in the October survey. Respondents from all sectors expect their firms will add jobs rather than reduce headcount in the near term.

• Fifty-six percent of respondents report there were no shortages of inputs in Q4 2020—slightly smaller than the percentage in the October survey. The largest increase is in the share of respondents reporting shortages in skilled labor—up from 16% in October to 24%. The share reporting shortages of unskilled labor increased from 2% to 7%.

• After negative readings for three straight quarters, the NRI for capital spending bounced back strongly in the fourth quarter, rising from -8 to 15—the highest reading in one year. Twenty-eight percent of respondents report that capital spending at their firms rose during Q4, up from 19% in Q3, with the percentage citing declining investments shrinking from 27% to 13%. Six-in-ten note no change in capital expenditures over the past three months. The forwardlooking NRI for capital spending is strongly positive, rising from 6 in October to 22 in January. The percentage of respondents expecting increased activity jumped from 19% to 34%.

• Businesses continue to make changes to employment and wages in response to COVID-19, albeit less so than in the October survey. Reducing employee headcount was the most common response, cited by 34% of respondents. But this is down from 54% in October and 68% in July.

• Respondents’ near-term outlook is little changed compared to that in the October survey. Thirty-four percent of respondents report a “Better” outlook compared to a month ago, down slightly from 36% in October. Only 6% cite a “Worse” near-term outlook, compared to 8% in the previous survey.

• Sales volumes improved in the fourth quarter of 2020. Fifty-two percent of respondents report sales volumes at “76-100% of pre-crisis level,” up from 46% in the previous survey. Furthermore, 23% indicate that sales at their companies are already above pre-crisis levels, matching the October reading, and led by the TUIC and goods-producing sectors.

• Nearly one-third (32%) of respondents reports that sales volumes have already returned to their normal level of operations, while 36% expect that to happen sometime in 2021.

• Only 5% of respondents report that their firms have either applied or are planning to apply for Main Street Lending programs, up slightly from 3% in the October survey.

• Roughly half (51%) of respondents anticipates that their firms will suspend their stay-at-home policies in the second half of 2021, up from 22% in the October survey.

• Eleven percent of panelists expect that all of the staff at their firms will eventually return to pre-pandemic working arrangements. Those from the services sector account for the largest share holding this view.

• Nearly half of respondents (46%) indicates that the vaccine rollout or new administration will have “No” impact on their firm’s outlook for sales, hiring, capex, etc. Conversely, 37% of respondents indicate “Yes, positive,” while 5% cite “Yes, negative.”

NABE Outlook Survey – December 2020

SUMMARY: “The NABE [National Association for Business Economics] Outlook panel anticipates more moderate growth in economic activity going forward after the sharp rebound during the third quarter,” said NABE President Manuel Balmaseda, CBE, chief economist, CEMEX. “The median forecast calls for a 4.1% annualized growth rate in the fourth quarter of 2020 for inflation-adjusted gross domestic product, or real GDP. In addition to the 33.1% GDP growth in the third quarter of the year, this would reverse much of the 32% annualized decline from the second quarter. However, the panel has become slightly less bullish about 2021. The median real GDP growth estimate for 2021 is 3.4%, slightly less than the 3.6% forecasted in the October survey.” “NABE panelists have become more optimistic, on balance, with nearly one-third revising their outlook higher based on recent news of effective vaccines,” added Survey Chair Holly Wade, executive director, NFIB Research Center. “Seventy-three percent of panelists believe that the economy will have returned to pre-pandemic GDP levels by the second half of 2021, 18% expect it to reach that level in the first half of 2022, and 10% believe it will occur in the second half of 2022 or later. The 73% is a dramatic improvement from the October survey in which 38% of panelists believed that a full recovery would occur before 2022. “Just over one-third of respondents anticipate more downside risk to economic growth in 2021,” continued Wade. “Panelists point to a second wave of COVID-19 cases as their main concern.”

The National Association for Business Economics (NABE) released its October Outlook Survey which is summarized as follows: “The NABE Outlook panel sees a strong rebound in economic activity after the collapse experienced during the second quarter,” said NABE Vice President Manuel Balmaseda, CBE, chief economist, CEMEX. “The median forecast calls for a 25% annualized growth rate in the third quarter of 2020 for inflation-adjusted gross domestic product, or real GDP. That would reverse much of the 31% annualized decline from the second quarter. However, the panel has become less bullish about the fourth quarter of 2020, as well as 2021. The median real GDP growth estimate for 2021 is 3.6%, compared to a 4.8% forecast in the June survey.”

“NABE panelists have become more optimistic, on balance, but remain concerned about a potential second wave of COVID-19,” added Outlook Survey Chair Eugenio Aleman, economist, Wells Fargo Bank. “Thirty-eight percent of panelists believe that the economy will have returned to pre-pandemic GDP levels by the second half of 2021, 32% expect it to reach that level in the first half of 2022, and 30% believe it will occur in the second half of 2022 or later.

“About half of the panelists put the odds of a double-dip recession at 20% or less,” continued Aleman. “In contrast, one out of eight panelists places those odds at 50% or higher.”

Other highlights from the survey:

The median forecast calls for the unemployment rate to average 8.4% in 2020, 2.5 percentage points lower than the median forecast in the previous survey. Panelists expect the unemployment rate to decline each quarter, averaging 6.8% in 2021, compared with the 8% previously forecasted. The unemployment rate averaged 3.7% in 2019.

Panelists look for business investment to drop sharply this year. Real nonresidential fixed investment is forecasted to decline 6%. Panelists anticipate real nonresidential fixed investment to rise only gradually in 2021, increasing 2.4%.

Survey respondents expect inflation—as measured by the GDP price index—to be significantly lower in 2020 and 2021 relative to 2019. Inflation is forecasted to be 1.0% in 2020 and 1.5% in 2021. The index increased 1.8% in 2019.

Panelists expect the consumer price index (CPI) to rise 1.2% in 2020, significantly lower than the actual 1.8% growth in consumer prices in 2019. The 2020 forecast median has increased since the June survey, when panelists saw CPI rising by 0.7%. The panel anticipates consumer price growth will pick up moving forward, with a 1.9% annual average gain in 2021.

Panelists expect corporate profits to contract by 11% in 2020. The median forecast calls for profits to increase by 8.5% in 2021.

Four out of ten panelists indicate that 5% of jobs will be permanently lost due to firms closing. More than half of the panel suggest between 10% and 20% of job losses will be permanent.

Thirty-eight percent of panelists believe that the economy will have returned to pre-pandemic GDP levels by the second half of 2021; only 2% suggest this will occur before the end of 2020, 12% believe GDP will recover in the first half of 2021, and 24% anticipate such a return in the second half of 2021. Thirty-two percent of respondents expect GDP to reach pre-pandemic levels in the first half of 2022, and 22% believe it will occur in the second half of 2022.

For a more in-depth review and analysis of the economy, please see our mini-book on economic analysis and forecasting entitled: Simple and Effective Economic Forecasting.

NABE October Business Conditions Survey

“The October NABE Business Conditions Survey shows that firms are continuing to gain ground since the sharp economic downturn experienced in the first half of the year,” said NABE President Manuel Balmaseda, CBE, chief economist, CEMEX. “This momentum is expected to continue through the rest of 2020. In addition, more respondents than in the July survey anticipate stronger growth in inflation-adjusted gross domestic product over the next year.” “More respondents in this survey report continued improvements, especially in sales and profit margins, at their firms during the past three months than in the July survey,” added NABE Business Conditions Survey Chair Holly Wade, executive director, NFIB Research Center. “Capital spending is also picking up steam, with more firms investing in their businesses over the past three months, and more planning to do the same in the next three months. “The employment picture is less rosy, with many firms still holding back on wage and staff increases,” continued Wade. “While slightly more respondents report an increase in employment at their firms over the last three months than in the previous survey, more also report a decrease in employment. Most firms are also forgoing raises to control costs with 70% of respondents’ firms reporting unchanged wages and salaries over the last two quarters, the highest reading since January 2014.”

Higlights

• The panel’s consensus outlook for the U.S. economy, measured by year-over-year growth in inflation-adjusted gross domestic product (real GDP), continued to improve in October compared to that in the two previous surveys. Eighty-nine percent of panelists expect real GDP to increase from the third quarter (Q3) of 2020 to Q3 2021. Only 9% of respondents expect the real GDP change to be zero or negative, compared to 31% of respondents who held this view in the July survey when asked about the outlook for the 12 months ending Q2 2021.

• For the first time since April 2019, a majority of respondents’ firms reports increased sales at their firms, with 52% indicating rising sales during Q3. The Net Rising Index (NRI) for sales—the percentage of panelists reporting rising sales minus the percentage reporting falling sales—surged upward, increasing 47 points to 33, up from -14 in July. The forward-looking NRI for anticipated sales over the next three months also rose, adding to the sharp increase reported in the July survey. The NRI for anticipated sales increased 13 points, from 18 in July to 31, with positive readings in three of the four industry sectors.

• Profit-margin increases were more widespread in Q3 2020, but remained less prevalent than decreases among respondents’ firms, with the NRI for profit margins increasing 21 points to -4. The share of respondents reporting rising profit margins increased from 15% in July to 21% in October, while the percentage reporting falling margins declined 15 percentage points—from 40% in July to 25% in October.

• The NRI for prices charged returned to neutral in October—registering +1—following the sharp decline during the first half of 2020, that brought the NRI in July to its lowest level since 1987. NRIs by sector, however, vary significantly. The NRI for goods-producing firms is 21, after registering -40 in July. But the index for finance, insurance, real estate (FIRE) sector firms remains negative with an NRI of -19. Between these extremes are the NRI for services, with a reading of 3, and the NRI of 8 for the transportation, utilities, information, communications (TUIC) sector. The share of respondents expecting price increases in the next three months rebounded from levels in the previous two surveys to 26% in October, resulting in an NRI of 20. Six percent anticipate falling prices in the next three months.

• The NRI for materials costs also rebounded from two quarters of negative readings to a reading of 10. All sectors registered positive NRIs, led by goods-producers at 15, bouncing back from -56 in July. The NRI for expected costs rose modestly, from 1 to 8, having been as low as -21 in April.

• Hiring at respondents’ firms remains depressed. The third-quarter NRI for employment levels over the last three months is -17, compared to -19 in the July survey. Even as the NRI improved, the share of respondents indicating there was decline in employment at their firms rose to 27% from 24% in the July survey. At the same time, 9% report employment increases at their firms, compared to 5% in July. The outlook for employment deteriorated in Q3, as the NRI for hiring expectations declined to just 1, down from 6 in the July survey. Respondents from the goods-producing and TUIC sectors expect their firms will add jobs in the next three months. In the July survey, three of the four sectors had positive NRIs for expected employment change in Q3 2020.

• The NRI for wages and salaries rebounded 13 points to 4 in the October survey. The upward movement in the index reflects an increase to 17% from 11% in July in the share of respondents citing rising wages, and a decrease to 13% from 19% in the share reporting falling wages. The forward-looking NRI for wages and salaries moved from 0 in July to 15 in October.

• Almost two-thirds of respondents report no shortages of inputs in Q3 2020, similar to results from the July survey. The share of respondents reporting shortages is virtually unchanged in the current survey across all inputs, except for a decline in the percentage indicating intermediate input shortages.

• The NRI for capital spending improved, from -19 in July to -8 in October. Fewer respondents report continuing declines in spending, while more indicate their firms’ capital spending increased during Q3 2020. However, service-sector panelists report not much improvement from the prior two readings. The forward-looking NRI for capital spending rose considerably, from -40 in April to 6 in October, as fewer respondents expect declines in spending over the next 3 months.

• In response to COVID-19, businesses continue to adjust employee headcount and wages. Imposing a hiring freeze is the most common response, cited by 69% of respondents.

• Respondents’ near-term outlook improved slightly in October compared to that in the July survey. Thirty-six percent of respondents report a “Better” near-term in October, compared to 34% in July. Only 8% indicate their near-term outlook is “Worse” in October, compared to 12% in July.

• Twenty-three percent of respondents report that sales at their companies are at “more than 100% of pre-crisis level,” an increase from the 15% in the July survey.

• Thirty-one percent of respondents expect sales to return to normal “sometime in 2021,” while 24% do not expect sales to return to normal until sometime in 2022. Only 10% expect sales to return to normal by the end of 2020.

• Only 3% of respondents report that their firms applied, or are planning to apply, for Main Street Lending programs.

• Thirty-five percent of respondents indicate their firms have implemented new work-at-home policies, allowing “all employees” to work from home during the pandemic. Another 33% allow “most employees” to work from home, while 16% only allow “some employees” to work from home.

• Thirty-one percent of respondents report that their firms will wait for “progress regarding COVID-19” before changing their work-from-home policies. Twenty-two percent indicate their companies will wait until the second half of 2021, while 16% of firms plan to suspend work-from-home policies in the first half of 2021.

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Conclusion

During this time of global flux due to the coronavirus, I am leaving the Conclusion discussion below the same as was posted on March 23, 2020. The March 23, 2020 discussion still adequately reflects my thinking on the current state of affairs.

Important Note: While I don’t believe it is time to jump back into the stock market in a big way because of the market’s overvaluation, I have been advising the last few of weeks in this Commentary and in my weekly podcast, Intrinsic Value Wealth Report Radio, that investors can continue building their investment portfolios by selecting individual securities that offer growth and value opportunities.

Reprinted from March 23, 2020

Up until the past week, the economy had been in a stable but somewhat vulnerable state. Nonetheless, it had remained fairly strong. In fact, robust consumer spending and strong labor market conditions had given us confidence that the economy, which had been in its tenth year of expansion, could continue to grow. But we were cautious on this outlook. There were several reasons for our caution. U.S. business growth had been mixed. And global economic growth had been mixed as well. The new coronavirus was becoming a global economic threat, although it was still too early to tell how much of an effect it would ultimately have. Debt is at high levels for consumers, businesses, and government (at all levels of government). Finally, this is an election year that will likely have significant consequences either positively or negatively depending on the outcome of the elections. And of course, it is still too early to tell what the outcome of the elections will be.

In just a few days, the coronavirus’s effect on the economy and the markets went from a ripple to a tsunami. Businesses are shuttering, events are being cancelled or postponed, grocery store shelves are empty, and people are being asked or ordered to stay home. The markets are now deep in bear market territory. The effects on the economy, even given the short time that the economy has been retreating, may be with us for a long time. There is now a much greater risk of a recession, and there has even been some talk of a depression. The government, the Fed, Republicans, and Democrats, and pretty much the entire country, is trying to get the virus under control and is coming up with plans to mitigate the long-term economic effects caused by the virus. But the virus has impacted the economy – in a significant way – in just a short time. How long lasting the effects will be no one can tell right now. The economy has been largely shut down and remains so today. It takes time to restart the economy after a situation such as what is occurring at the present time.

Given these events and the rapidly deteriorating situation, as I said last week, I would caution not to panic. The economy and the markets will get better. The situation is bad – there is no doubt about that – but it will turn around. The real question is when will it turn around? No one knows that at the present time. But it will turn around.

For now, review your investment portfolios. It is highly likely that all or most of your stocks are down. You should not consider selling the bulk of your stocks – only consider selling companies that are not sound companies. But do recognize that as the economy deteriorates, even good companies will be affected.

For stock market value hunters, we believe it is still too early to jump back in. We will be closely monitoring the markets using the many tools and models that we have developed over the years to assess the economy and the markets. We will use our best judgement and thoughts to let you know when we believe things are turning around. The turnaround hasn’t happened yet.

We believe it is important to maintain a long-term view toward investing. But for now, just sit tight. Eventually, this means that you should continue building your investment portfolio using the Cassandra Stock Selection Model to select individual securities that offer growth and value opportunities.

Chart for Review and Thought

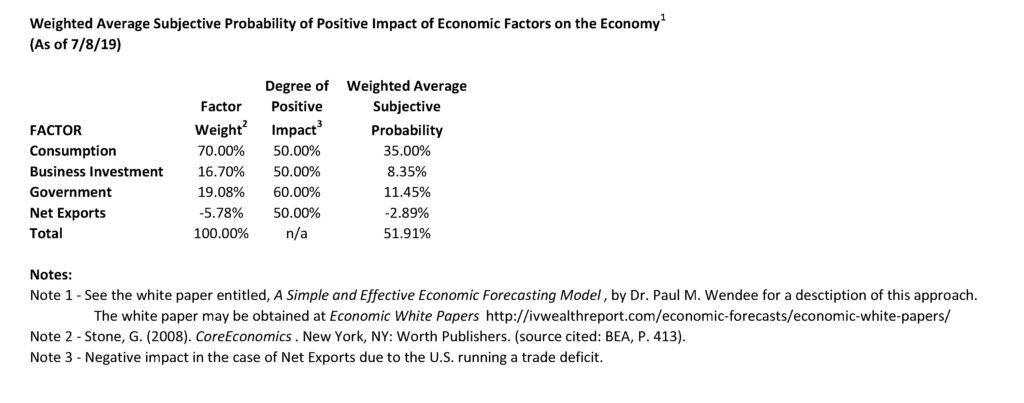

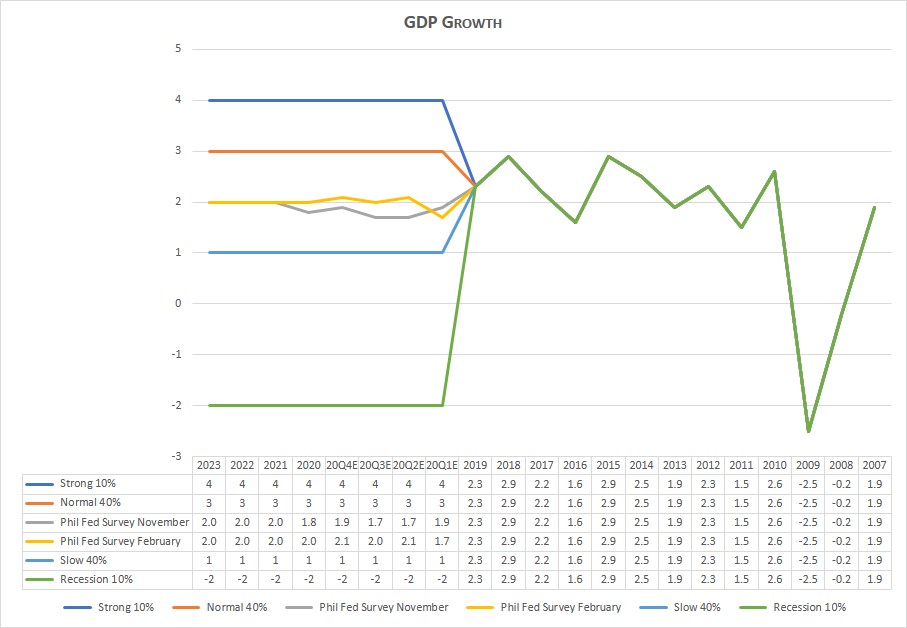

Simple and Effective Economic Forecasting Model

Note: The table and chart below have not been updated. However, we believe that a recession is quite likely. In the chart below, the bottom green line shows what a recession could look like.

Notes (GDP Growth Chart):

- See the July 8, 2019 Commentary for an introduction to this model.

- Actual numbers 2007 through 2019; forecasted numbers thereafter.

- Normal GDP growth is typically in the 2% to 3% range.

- A recession is generally defined as two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

Thought for the Week

“Never Let A Good Crisis Go To Waste” ~ Winston Churchill

Announcements

The Intrinsic Value Wealth Report has started a new YouTube channel called Intrinsic Value Wealth Report TV. You can view the YouTube channel at Intrinsic Value Wealth Report TV.

The Intrinsic Value Wealth Report has started a new podcast called Intrinsic Value Wealth Report Radio. You can listen to the podcast at Intrinsic Value Wealth Report Radio.

Dr. Wendee spoke at the Investment Club of America’s annual economic summit, called Econosummit, on Sunday March 1, 2020 in Las Vegas.

Dr. Wendee attended the The National Due Diligence Alliance (TNDDA) investment banking conference, which was held March 6-8, 2020 at the Four Seasons Resort in Dallas, Texas. This is a conference held several times throughout the year for investment bankers and registered investment advisers to learn about new opportunities in the Alternative Investment asset classes.

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the next few weeks to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers. We have been testing our crowdsourcing models with students and have been having good success and results.

Dr. Wendee has been researching and writing a new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics). The full paper on Intrinsinomics will be published in the near future.

Finance 3350: Personal Finance-Portfolio & Risk Management– Dr. Wendee taught teaching Finance 3350 – Portfolio & Risk Management at California State University, Los Angeles (CSULA) for the Summer term starting May 2020. Dr. Wendee teaches courses in Management and Finance at CSULA.

Business 548: Strategy and Decision Making – Dr. Wendee taught Business 548 – Strategy and Decision Making at California Baptist University (CBU) starting at the end of June 2020. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Business 303: Business Finance – Dr. Wendee taught Business 303 – Business Finance at California Baptist University (CBU) starting at the end of August 2020. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Business 539: Financial Management – Dr. Wendee is teaching Business 539 – Financial Management at California Baptist University (CBU) which started at the end of October. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Business 217: Microeconomics – Dr. Wendee is teaching Business 217 – Microeconomics at California Baptist University (CBU) which started in January 2021. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Business 218: Macroeconomics – Dr. Wendee is teaching Business 218 – Macroeconomics at California Baptist University (CBU) which started in January 2021. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Finance 430: Risk Management – Dr. Wendee is teaching Finance 430 – Risk Management at California Baptist University (CBU) which started in January 2021. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Dr. Wendee presented a paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which was held in Ottawa, Canada last Fall.

Dr. Wendee presented an updated paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which was to have been held in San Francisco, California in November, but which was held virtually instead due to the Coronavirus.

Dr. Wendee delivered a talk entitled: Using Alternative Assets to Increase Portfolio Returns and Decrease Risk at the BrightTalk Q4 2020 Outlook Summit on October 28, 2020. You can access additional information on the summit and Dr. Wendee’s presentation here.

Dr. Wendee delivered a talk at the BrightTalk conference on December 9, 2020 entitled: Emerging Themes and Great Places to Invest for 2021. You can access additional information on the summit and Dr. Wendee’s presentation here.

Dr. Wendee delivered a talk at the BrightTalk conference on January 20, 2021 entitled: Developing an Income-Producing Strategy for 2021 and Beyond. You can access additional information on the summit and Dr. Wendee’s presentation here.

Dr. Wendee is working on a financial planning modeling program which will be available in the near future. The modeling program is designed to assist anyone in creating a financial plan and is customizable for each person’s unique financial planning goals. A working draft of the model is currently in beta test with students. Click this link, schematic, to go to the clickable document under the subheading Financial Planning Process (Draft) in the Intrinsic Value Wealth Report to see a draft of the schematic for the new financial planning process.

Dr. Wendee has been developing an econometric model specifically designed to monitor and forecast the global economy as this current economic crisis unfolds. This new econometric model is based on other econometric models that he has designed and have used for many years. You can find some of these earlier models in Book # 6 – Simple and Effective Economic Forecasting in the sister website to this website which is called the Intrinsic Value Wealth Report. The new econometric model has been constructed with some additional tools and methods that he has learned and some that he has developed over the last several years. He will be talking more about this new econometric model in this Commentary over the next few months. His comments and forecasts on the economy and the markets going forward will be based to a significant extent on this new model.

We have begun raising capital for our fund-of-funds investment, Northwest Quadrant Opportunity Fund, LLC. The fund engineers and constructs an investment vehicle consisting of Alternative Asset investments. The fund’s objective is to build a diversified portfolio of strong, solid, steady- performing assets, with highly qualified asset managers who have proven track records that meet our underwriting requirements. To learn more about the Northwest Quadrant Opportunity Fund, LLC and to obtain an offering memorandum, please click Northwest Quadrant Opportunity Fund, LLC.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine of the Best Ways to Build Wealth.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.