Maybe Not ‘Irrationally Exuberant’ – But Definitely Overvalued

Is the market “irrationally exuberant”? That was a question posed in December 1996 by Alan Greenspan, who was the Chairman of the Federal Reserve at the time. In an article written today by Mark Hulbert (2020), a columnist for the Wall Street Journal, Mr. Hulbert recalls this famous Greenspan speech and asks the same question about today’s market: “Are stock investors ‘irrationally exuberant again?”

To help answer this question, Hulbert reviews a 2006 paper written by Malcom Baker and Jeffrey Wurgler (Baker and Wurgler, 2006), two university professors who tried to quantify investor sentiment and its effect on the markets. Their research, conducted at the end of the internet bubble, identified five variables that might characterize investor exuberance. The five variables are: (1) the number of initial public offerings (IPOs); (2) the first day average return of those initial public offerings; (3) how public companies raised their capital – equity or debt; (4) the relative valuations of dividend versus non-dividend paying stocks; and (5) the average closed-end fund discount.

Here is how today compares with the years in the study, according to Hulbert (2020). In calendar year 1999 (the last full year before the top of the internet bubble), there were 476 IPOs whereas there have only been 44 IPOs so far this year. In 1999, the average first-day IPO return was 71% versus 34% for this year. The equity percentage of capital raised in 1999 was 18%; today it stands at 7.5%. The relative valuation of dividend paying stocks is 44% higher than non-dividend paying stocks, a reversal from the 1999 period, suggesting that investors are not chasing growth stocks as much as they did in 1999. And finally, the discount on closed-end funds is deep by historical standards, suggesting there is a great deal of fear in the market. Given this data, Hulbert concludes that the market is not irrationally exuberant at the present time.

While the stock market may not be acting in an irrationally exuberant manner, we believe that the market is definitely overvalued. As of Thursday, July 3rd, the Dow Jones Industrial Average was trading at a price-to-earnings ratio of 21.74 and the S&P 500 was trading at a price-to-earnings ratio of 22.44. Those are overvalued markets. Based on our research, a normal range for price-to-earnings ratios is in the range of 15 to 18. We refer again, as we have done in the past, to the chart on the S&P 500 Forward P/E and Annualized 10-Year Returns chart (please sign up for the free account at this link to view this chart if you don’t already have an account – the chart is near the bottom of this page). As you can see in this chart, around 20 percent of the returns were in the negative area of the chart. These were periods of time when investors were probably very irrationally exuberant and buying in very overpriced markets. Overpriced markets are prime examples of when investors are wrong in their assessment of the prospects for these markets. And as the results show, these are times when the markets were comprised of investors that were indeed wrong in their assessment.

References

Baker, M. and J. Wurgler (2006). “Investor sentiment and the cross-section of stock returns.” The Journal of Finance LXI(4).

Hulbert, M. (2020). Are stock investors ‘Irrationally Exuberant’ again? The Wall Street Journal. New York: Dow Jones & Company Inc.

Economic and Investment Highlights

Last Week

Chesapeake filed for bankruptcy.

Private equity firms have a huge stockpile of cash, totaling $1.45 trillion as of June.

Delta is set to send notices to 2500 pilots warning of possible furloughs.

More than 40% of S&P 500 companies have suspended their earnings guidance.

Banks have pulled back lending to U.S. consumers.

The Fed opened its $500 billion program to support debt issuance by large corporations.

There are an increasing number of regions in the U.S. pausing or rolling back reopenings due to the surge in coronavirus cases.

U.S. stocks ended the quarter with the best quarter gain in percentage terms in 20 years.

Airbus is cutting 15,000 jobs, which is 11% of its workforce.

China’s economic recovery accelerated in June with government support.

Fauci warned that new coronavirus cases in the U.S. could reach 100,000 per day if people continue to ignore social distancing and face mask precautions.

Americans will continue to be barred from entering the EU except for essential matters.

China continued to tighten its grip on Hong Kong. Thousands of people in Hong Kong protested.

Major auto makers posted sharp drops in second quarter U.S. auto sales.

Unemployment fell in June but faces the possibility of rising again as the number of coronavirus cases surges.

The CBO said that the U.S. economic downturn will be more severe than previously forecast, with unemployment remaining in double-digits through year-end.

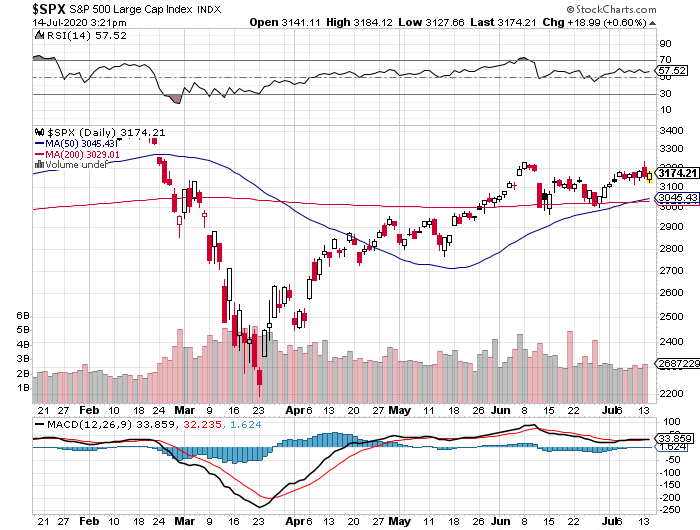

The Dow, the S&P 500, and the Nasdaq rose for the week. The Dow was up 3.2%; the S&P 500 was up 4.02%; and the Nasdaq was up 4.6%. The 10-year treasury yield ended the week at 0.670%. Gold closed at $1,784.00 (Thursday) for the week. Oil closed at $40.65 for the week.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The models below may not capture the impact of COVID-19 beyond their impact on GDP source data and relevant economic reports that have already been released. They may not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the models.

Note: The comments that follow are derived from the economic indicators referenced in the Resources section of this newsletter and other sources in this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) had been trending up for several weeks from having dipped in 2019. Recently with the advent of the economic collapse, the index crashed. It has now been trending up again.This is a positive indicator for the economy on a short-term basis.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -45.4 percent. This reading differs from the ALS model assessment of an improving short-term economic environment.

The New York Fed Staff Nowcast stands at -25.9% for 2020:Q2 and -12.5 for 2020:Q3.

The Chicago Fed National Activity Index (CFNAI) showed a decrease in economic activity in April. The Chicago Fed National Activity Index (CFNAI) was 2.61 in May, up from -17.89 in April.

All told, these short-term economic indicators are a mixed analysis for the economy, at least on a short-term basis.

Expectations that stock prices will rise over the next six months is now at 24.4% in a recent AAII Sentiment Survey. The historical average is 38.0% for the survey. 27.8% of the investors in the survey described their short-term outlook as neutral and 47.8% were bearish. Please see the AAII Sentiment Survey for the complete results.

The latest Gross Output (GO) reading (April 6, 2020) showed that Gross Output slowed significantly in the fourth quarter of 2019.

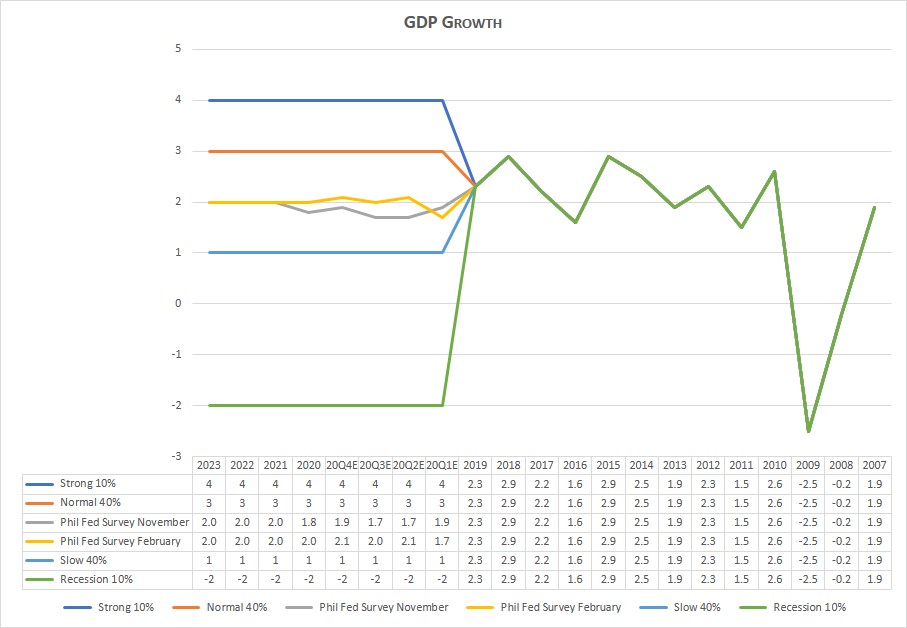

On a longer-term basis, the forecasters in the Philadelphia Fed’s Survey of Professional Forecasters (as of May 15, 2020) predict real GDP will contract at an annual rate of -32.2 percent for the second quarter of 2020; and increase at 10.6 percent for the third quarter of 2020, 6.5 percent in the fourth quarter of 2020, 6.8 percent in the first quarter of 2021, and 4.1 percent in the second quarter of 2021. On an annual-average over annual-average basis, the forecasters predict real GDP to contract -5.6 percent in 2020; and grow 3.1 percent in 2021, 4.1 percent in 2022 and 2.2 percent in 2023. The forecasters predict the unemployment rate will be above 10.0 percent over the next three quarters (16.1 percent in Q2, 12.9 percent in Q3, and 11.0 percent in Q4); will be 10.8 percent in 2020; 8.1 percent in 2021, 6.2 percent in 2022, and 5.1 percent in 2023. The next survey release date is August 14, 2020.

The National Association for Business Economics (NABE) released an Outlook Flash Survey on April 10, 2020. The NABE panel expects GDP declines in Q1 2020 and Q2 2020, and upticks in Q3 2020 and Q4 2020. The panel believes the U.S. economy is already in a recession and predicts real GDP will grow at an annual rate of -2.4 percent for the first quarter of 2020, -26.5 percent for the second quarter of 2020, 2.0 percent in the third quarter of 2020, 5.8 percent in the fourth quarter of 2020, and 6.0 percent in the first quarter of 2021. The forecasters expect unemployment to average 3.8% in Q1 2020. The median unemployment rate projection for Q2 2020 is 12.0%. The unemployment rate is expected to fall back to 9.5% at the end of 2020, and to 6.0% at year-end 2021. The panel’s forecast for the PCE price index less food and energy calls for a slowdown in the annual rate of change from 1.7% in Q1 to 0.8% in Q2 2020. The panel expects the rate to increase gradually to 1.7% in the last half of 2021.

For a more in-depth review and analysis of the economy, please see our mini-book on economic analysis and forecasting entitled: Simple and Effective Economic Forecasting.

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Conclusion

During this time of global flux due to the coronavirus, I am leaving the Conclusion discussion below the same as was posted on March 23, 2020. The March 23, 2020 discussion still adequately reflects my thinking on the current state of affairs.

Important Note: While I don’t believe it is time to jump back into the stock market in a big way because of the market’s overvaluation, I have been advising the last few of weeks in this Commentary and in my weekly podcast, Intrinsic Value Wealth Report Radio, that investors can continue building their investment portfolios by selecting individual securities that offer growth and value opportunities.

Reprinted from March 23, 2020

Up until the past week, the economy had been in a stable but somewhat vulnerable state. Nonetheless, it had remained fairly strong. In fact, robust consumer spending and strong labor market conditions had given us confidence that the economy, which had been in its tenth year of expansion, could continue to grow. But we were cautious on this outlook. There were several reasons for our caution. U.S. business growth had been mixed. And global economic growth had been mixed as well. The new coronavirus was becoming a global economic threat, although it was still too early to tell how much of an effect it would ultimately have. Debt is at high levels for consumers, businesses, and government (at all levels of government). Finally, this is an election year that will likely have significant consequences either positively or negatively depending on the outcome of the elections. And of course, it is still too early to tell what the outcome of the elections will be.

In just a few days, the coronavirus’s effect on the economy and the markets went from a ripple to a tsunami. Businesses are shuttering, events are being cancelled or postponed, grocery store shelves are empty, and people are being asked or ordered to stay home. The markets are now deep in bear market territory. The effects on the economy, even given the short time that the economy has been retreating, may be with us for a long time. There is now a much greater risk of a recession, and there has even been some talk of a depression. The government, the Fed, Republicans, and Democrats, and pretty much the entire country, is trying to get the virus under control and is coming up with plans to mitigate the long-term economic effects caused by the virus. But the virus has impacted the economy – in a significant way – in just a short time. How long lasting the effects will be no one can tell right now. The economy has been largely shut down and remains so today. It takes time to restart the economy after a situation such as what is occurring at the present time.

Given these events and the rapidly deteriorating situation, as I said last week, I would caution not to panic. The economy and the markets will get better. The situation is bad – there is no doubt about that – but it will turn around. The real question is when will it turn around? No one knows that at the present time. But it will turn around.

For now, review your investment portfolios. It is highly likely that all or most of your stocks are down. You should not consider selling the bulk of your stocks – only consider selling companies that are not sound companies. But do recognize that as the economy deteriorates, even good companies will be affected.

For stock market value hunters, we believe it is still too early to jump back in. We will be closely monitoring the markets using the many tools and models that we have developed over the years to assess the economy and the markets. We will use our best judgement and thoughts to let you know when we believe things are turning around. The turnaround hasn’t happened yet.

We believe it is important to maintain a long-term view toward investing. But for now, just sit tight. Eventually, this means that you should continue building your investment portfolio using the Cassandra Stock Selection Model to select individual securities that offer growth and value opportunities.

Chart for Review and Thought

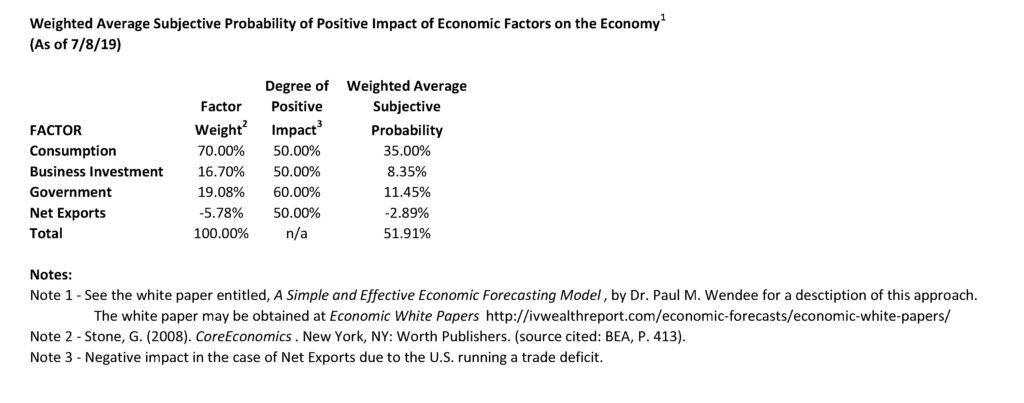

Simple and Effective Economic Forecasting Model

Note: The table and chart below have not been updated. However, we believe that a recession is quite likely. In the chart below, the bottom green line shows what a recession could look like.

Notes (GDP Growth Chart):

- See the July 8, 2019 Commentary for an introduction to this model.

- Actual numbers 2007 through 2019; forecasted numbers thereafter.

- Normal GDP growth is typically in the 2% to 3% range.

- A recession is generally defined as two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

Thought for the Week

“How do we know when irrational exuberance has unduly escalated asset values?” ~ Alan Greenspan (December 1996)

Announcements

The Intrinsic Value Wealth Report has started a new YouTube channel called Intrinsic Value Wealth Report TV. You can view the YouTube channel at Intrinsic Value Wealth Report TV.

The Intrinsic Value Wealth Report has started a new podcast called Intrinsic Value Wealth Report Radio. You can listen to the podcast at Intrinsic Value Wealth Report Radio.

Dr. Wendee spoke at the Investment Club of America’s annual economic summit, called Econosummit, on Sunday March 1, 2020 in Las Vegas.

Dr. Wendee attended the The National Due Diligence Alliance (TNDDA) investment banking conference, which was held March 6-8, 2020 at the Four Seasons Resort in Dallas, Texas. This is a conference held several times throughout the year for investment bankers and registered investment advisers to learn about new opportunities in the Alternative Investment asset classes.

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the next few weeks to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers. We have been testing our crowdsourcing models with students and have been having good success and results.

Dr. Wendee has been researching and writing a new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics). The full paper on Intrinsinomics will be published in the near future.

Finance 3350: Personal Finance-Portfolio & Risk Management– Dr. Wendee started teaching Finance 3350 – Portfolio & Risk Management at California State University, Los Angeles (CSULA) for the Summer term starting May 2020. Dr. Wendee teaches courses in Management and Finance at CSULA.

Business 548: Strategy and Decision Making – Dr. Wendee will be teaching Business 548 – Strategy and Decision Making at California Baptist University (CBU) starting at the end of June 2020. Dr. Wendee teaches courses in Finance, Business, Strategy & Decision Making, and Economics at CBU.

Dr. Wendee presented a paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which was held in Ottawa, Canada last Fall.

Dr. Wendee will present an updated paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which will be held in San Francisco, California in November.

Dr. Wendee is working on a financial planning modeling program which will be available in the near future. The modeling program is designed to assist anyone in creating a financial plan and is customizable for each person’s unique financial planning goals. A working draft of the model is currently in beta test with students. Click this link, schematic, to go to the clickable document under the subheading Financial Planning Process (Draft) in the Intrinsic Value Wealth Report to see a draft of the schematic for the new financial planning process.

Dr. Wendee has been developing an econometric model specifically designed to monitor and forecast the global economy as this current economic crisis unfolds. This new econometric model is based on other econometric models that he has designed and have used for many years. You can find some of these earlier models in Book # 6 – Simple and Effective Economic Forecasting in the sister website to this website which is called the Intrinsic Value Wealth Report. The new econometric model has been constructed with some additional tools and methods that he has learned and some that he has developed over the last several years. He will be talking more about this new econometric model in this Commentary over the next few months. His comments and forecasts on the economy and the markets going forward will be based to a significant extent on this new model.

We have begun raising capital for our fund-of-funds investment, Northwest Quadrant Opportunity Fund, LLC. The fund engineers and constructs an investment vehicle consisting of Alternative Asset investments. The fund’s objective is to build a diversified portfolio of strong, solid, steady- performing assets, with highly qualified asset managers who have proven track records that meet our underwriting requirements. To learn more about the Northwest Quadrant Opportunity Fund, LLC and to obtain an offering memorandum, please click Northwest Quadrant Opportunity Fund, LLC.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine Of The Best Ways To Build Wealth.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.