FreedomFest

Dr. Paul was a moderator on two panels and spoke on a third panel at FreedomFest this past week.

The first panel he spoke on was a discussion of a film on the broken U.S. patent system. The panel was called, “Out of our own Minds: Do Patents Foster Innovation or Kill It?” The film was titled, “Invalidated.” Besides Dr. Paul, the other panelists were Jenny Beth Martin, co-founder of Tea Party Patriots Action which formed the beginning of the Tea Party Movement; Luke Livingston, the Director of the movie “Invalidated”; and George Gilder, the well-known investor, writer, economist, techno-utopian advocate, Republican Party activist, and co-founder of the Discovery Institute.

For his second panel, which he moderated, Dr. Paul was joined by Jeff Barnes, CEO of Angel Investor Network and Neil Dikeman, a fund manager and Libertarian US Senate Nominee for Texas in 2018. The title of their discussion was: “It’s Capital! How to Succeed with Venture Capital for Your Business.”

The third panel, which Dr. Paul also moderated, consisted of four well-know investors: Louis Navellier, Peter Schiff, Alex Green, and Doug Casey. The title of their panel, which was a discussion of investing in the current market climate, was: “Ridin’ the Bull, Huntin’ the Bear.”

Recordings of these three panels are available.

Economic and Investment Highlights

Last Week

China is expected to roll out more incentives to get businesses and consumers spending as its economic growth continues to slow.

Hispanics are experiencing the largest home ownership gains of any ethnic group in the U.S. They were previously the hardest hit ethnic group in the housing bust.

Consumption spending and factory production both increased in June.

The White House and Congress agreed on overall spending levels and raising the debt ceiling. But talks continue on how to fund the spending agreement. The federal budget deficit is expected to grow to over $1 trillion dollars during the Trump administration.

The House passed a bill to increase the federal minimum wage to $15 per hour by 2025. It is not expected to see a vote in the Senate and is opposed by the White House. While a Congressional Budget Office study showed it could lift 1.3 million people out of poverty, the same study also showed that 1.3 million people could lose their jobs. The current federal minimum wage is $7.25.

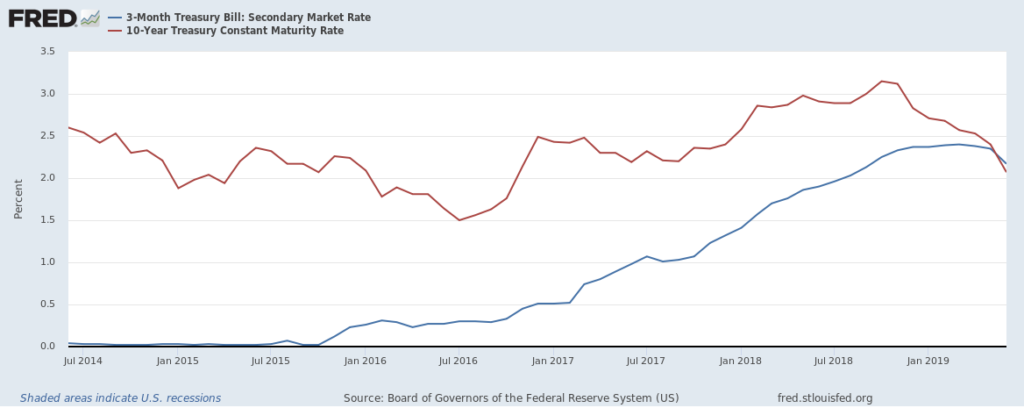

The Fed again signaled that it is prepared to lower interest rates by a quarter of a percentage point.

The biggest tech companies are propelling the major U.S. indexes higher. Microsoft, Apple, Amazon, and Facebook together accounted for about one-fifth of the gain in the S&P 500 this year. This is in line with similar results in 2017 and 2018.

Tax rates at many public companies have fallen as a result of the tax overhaul.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq all fell last week, 0.7% for the Dow, 1.23% for the S&P 500 and 1.2% for the Nasdaq. The 10-year treasury yield ended the week at 2.048%.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The comments that follow are derived from the economic indicators referenced in the Resources section of this newsletter and other sources in this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) has been trending up the last several weeks and has now crossed over the zero line into positive territory. The ALS Index rose slightly this past week. This is a very positive indicator for the economy on a short-term basis.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is n/a. This slight adjustment continues to support the ALS model assessment of an improving short-term economic environment.

The New York Fed Staff Nowcast stands at 1.5% for 2019:Q2 and 1.8% for 2019:Q3.

The Chicago Fed National Activity Index (CFNAI) showed an increase in economic activity in May. The Chicago Fed National Activity Index (CFNAI) was –0.05 in May, up from –0.48 in April.

All told, these short-term economic indicators are a neutral to positive analysis for the economy, at least on a short-term basis.

Expectations that stock prices will rise over the next six months rose this past week and is now at n/a, an unusually low level, in the latest AAII Sentiment Survey. The historical average is 38.5% for the survey. Please see the AAII Sentiment Survey for the complete results.

The latest Gross output (GO) reading suggests slow economic growth as we enter 2019.

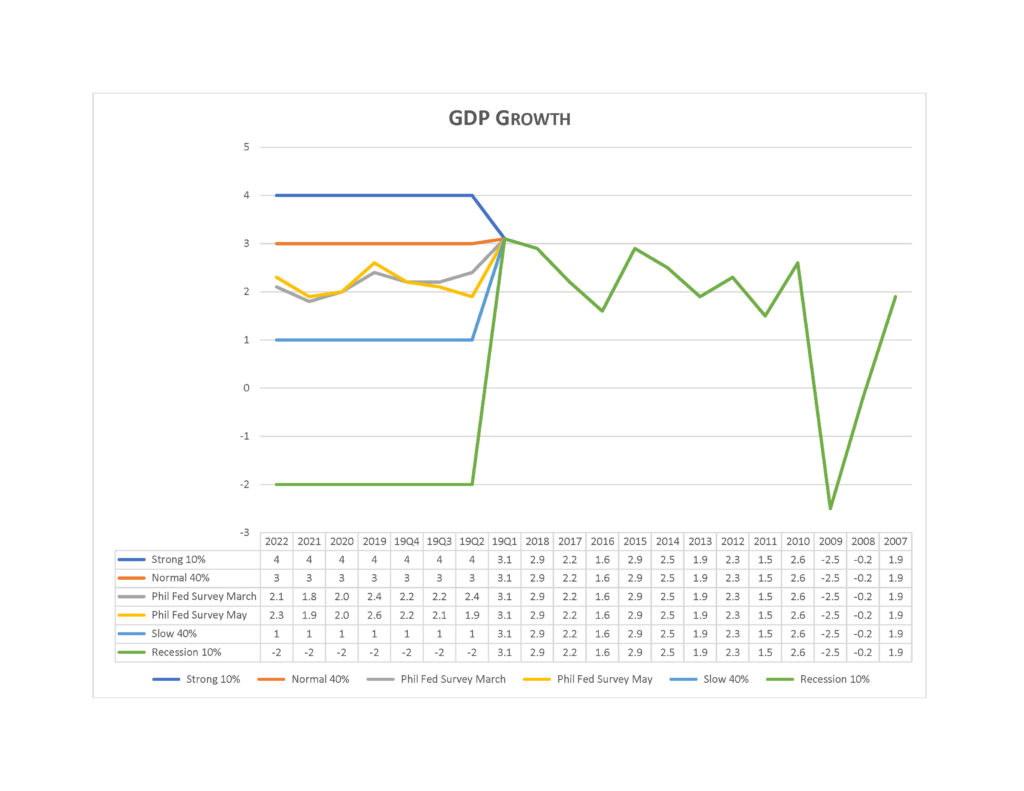

On a longer-term basis, the forecasters in the Philadelphia Fed’s Survey of Professional Forecasters (as of May 10, 2019) predict real GDP will grow at an annual rate of 1.9 percent this quarter and 2.1 percent next quarter. On an annual-average over annual-average basis, the forecasters predict real GDP to grow 2.6 percent in 2019, 2.0 percent in 2020, 1.9 percent in 2021 and 2.3 percent in 2022. The forecasters predict the unemployment rate will average 3.7 percent in 2019, 3.6 percent in 2020, 3.7 percent in 2021, and 3.9 percent in 2022.

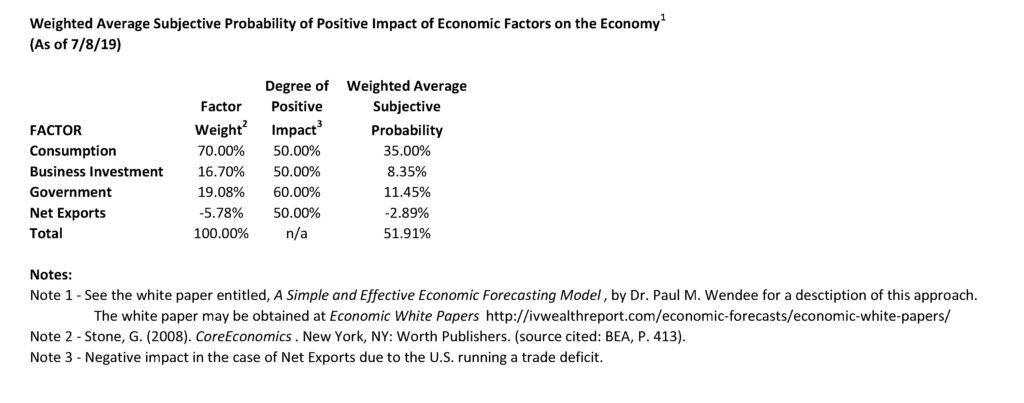

For a more in-depth review and analysis of the economy, please see our mini-book on economic analysis and forecasting entitled: Simple and Effective Economic Forecasting.

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Conclusion

We continue to believe the economy is in a stable but now more vulnerable state. Recent economic reports have been showing signs of weakening. Nonetheless, the economy has remained fairly strong. In fact, the extremely strong first quarter GDP showing and the strong labor market conditions still give us confidence that the economy, now in its tenth year of expansion, can continue to grow. But we are cautious on this outlook! Please see our complete Economic and Investment Review in the Spring 2019 quarterly issue of the Intrinsic Value Wealth Report Newsletter.

The broad market remains overvalued, although the Dow Jones Industrial Average looks more fairly valued than the broad market. But that does not mean that a market correction is imminent. Markets can and do stay overvalued for long periods of time. As discussed above and in the Economic and Investment Highlights section of this Commentary, we believe the economy is in a stable but vulnerable state that is showing signs of weakening. If the economy remains strong, the markets will likely remain strong. If the economy deteriorates, the markets may well correct. There are other events that could trigger a market correction, of course, but economic conditions are the most likely and foreseeable events that could make that happen.

We believe it is important to maintain a long-term view toward investing. This means that you should continue building your investment portfolio using the Cassandra Stock Selection Model to select individual securities that offer growth and value opportunities.

Chart for Review and Thought

Simple and Effective Economic Forecasting Model

Notes (GDP Growth Chart):

- See the July 8, 2019 Commentary for an introduction to this model.

- Actual numbers 2007 through Q1 2019; forecasted numbers thereafter.

- Normal GDP growth is typically in the 2% to 3% range.

- A recession is generally defined as two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

Announcements

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the next few weeks to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers.

Dr. Paul spoke at FreedomFest during its annual conference in Las Vegas, July 17 – 20, 2019. Please see above for a summary of his panels.

Business 539 – Financial Management – On July 1, 2019, Dr. Wendee started teaching Business 539 – Financial Management at California Baptist University (CBU). Dr. Wendee teaches courses in Finance and Economics at CBU.

Management 3080 – Business Responsibility in Society – Dr. Wendee will be teaching Management 3080 – Business Responsibility in Society at California State University, Los Angeles (CSULA) starting August 22, 2019. Dr. Wendee teaches courses in Management at CSULA.

Business 217 – Microeconomics – Dr. Wendee will be teaching Business 217 – Microeconomics at California Baptist University (CBU) starting September 4, 2019. Dr. Wendee teaches courses in Finance and Economics at CBU.

Business 218 – Macroeconomics – Dr. Wendee will be teaching Business 218 – Macroeconomics at California Baptist University (CBU) starting September 4, 2019. Dr. Wendee teaches courses in Finance and Economics at CBU.

Dr. Wendee will be presenting a paper on enterprise value creation at the International Leadership Association’s annual global conference which is being held in Ottawa, Canada this Fall.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine Of The Best Ways To Build Wealth.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.