~ Un-Common Sense In An Irrational World: We Challenge the Conventional Wisdom ~

Letter from the Editor: A New Direction (Again)

We are pleased to be back after having paused publication of the Intrinsic Value Wealth Report Newsletter for a few months.

The publication was paused for three reasons: (1) Dr. Wendee embarked on a very large project, which is now complete and well underway (see the following paragraph); (2) Dr. Wendee had a very busy travel and teaching schedule during most of this year; and (3) we wanted to work on a new direction and focus for the newsletter.

As to one of our big projects, Dr. Wendee joined with Exemplar Capital as Managing Director and Head of Investment Banking. In this capacity, he is building an investment banking operation that includes traditional investment banking (e.g., Reg A offerings and IPOs); alternative investments (e.g., real estate and oil & gas funds); and crowdfunding (Reg CF and non-Reg CF). This is the tenth such operation he has built over the last forty years.

Having worked through these various factors that caused us to take a break, we are now back. And we are back even better than before. You might have noticed that we have a new tagline for the newsletter: “Un-Conventional Wisdom in an Irrational World: We Challenge the Conventional Wisdom.” Our tagline represents the new focus we have taken for the newsletter. We will be covering the same topics and content as before, plus some new topics and content which you will see as we go forward. We are also taking a less “hands-off” approach to issues and tackling issues more “head-on.” We think you will like our new approach.

A lot of our new discussion will be centered on a new economic theory that Dr. Wendee created called, A Value Creation Theory of the Economy. The theory is also known as Intrinsinomics. The theory can be described as follows: The purpose of this economic study, using the grounded theory research design and an extensive review of, and incorporation of, other economic and financial models and theories, is to explore how free-market-based, capitalistic economies operate through business enterprises to create economic prosperity. The current study follows from the author’s previous research in creating a theory in the field of finance, A Theory of Value Drivers – A Grounded Theory Study, that explored the drivers that create value in enterprises. The basic premise of the current study is that it is the creation of enterprise value by businesses that creates value in the economy, which leads to economic prosperity for all economic actors and participants. You can access the complete economic study at this link: Intrinsinomics.

We want to emphasize that it is never our intent to offend anyone in this publication or in our podcast. We are big believers in civility and respect. But the nature of many of the topics will undoubtedly lead to some people being offended by certain discussions. That is inevitable and is necessary in a society that prizes open and honest communication. We will always endeavor to keep our discussions civil and respectful; but we will address the issues as we see them (in other words, “we call ‘em as we see ‘em”).

Our podcast has been resumed too. Be sure to check out our podcast at this link: Intrinsic Value Wealth Report Radio. The podcast has a tagline of: “After the Ballots Are Counted – Economic Thinking for the Future.” The podcast was so named as it was reborn after the 2022 mid-term elections. Its aim is to provide policymakers on both sides of the aisle with a clearer picture of what actually creates economic prosperity, which leads to a higher standard of living for everyone; and how their actions as policymakers influence that outcome.

A significant benefit of the new direction for the newsletter and the podcast is to provide our readers with a broader and clearer understanding of the global economic and investment climate, so that they can make better investment decisions. Intrinsinomics was specifically created for policymakers, investors, and global citizens to better understand how economic prosperity is created. It is the creation of economic prosperity that leads to a higher standard of living for everyone.

Finally, we wish to announce that we will be opening up to new investors in the near future the opportunity to invest in two hedge funds that we manage: (1) Northwest Quadrant Alternative Investments Opportunity Fund; and (2) Northwest Quadrant Alternative Investments Venture Fund. You can click the links to learn more.

Northwest Quadrant Alternative Investments Opportunity Fund, LLC invests in alternative investments such as real estate; oil & gas; and private equity. These alternative assets generally provide higher returns than stocks and bonds. If managed properly, the overall risks of a portfolio can be reduced substantially. We believe that our Double Alpha Strategy* of investing in these alternative investments can provide the mechanism for achieving high returns, while also providing appropriate and effective risk reduction. There is no guarantee, of course, that these investment objectives can be attained. Please see the disclaimers at the end of this page and at the link to the Northwest Quadrant Alternative Investments Opportunity Fund page.

Northwest Quadrant Alternative Investments Venture Fund, LLC invests in early-stage companies that have higher return potential than other assets and asset classes. The overall returns for these early-stage venture capital types of investments can be in the 25% to 35% range. While these assets also have higher risk than other assets and asset classes, if managed properly, the overall risks of a portfolio can be reduced substantially. We believe that our Double Alpha Strategy* of investing in these alternative investments can provide the mechanism for achieving high returns, while also providing appropriate and effective risk reduction. There is no guarantee, of course, that these investment objectives can be attained. Please see the disclaimers at the end of this page and at the link to the Northwest Quadrant Alternative Investments Venture Fund page.

* Our Double Alpha Strategy consists of:

- Picking highly qualified asset managers, in the case of the Opportunity Fund; or picking well-researched individual companies, in the case of the Venture Fund.

- Diversifying across asset classes; individual assets; and asset managers (in the case of the Opportunity Fund).

We are accepting indications of interest from investors who may wish to invest in these funds. Each fund has a target raise of $5 million, so please get your indications of interest to us as soon as possible, as we expect that these funds will reach their target raise quickly. If you are interested, please email Dr. Paul Wendee at pwendee@pmwassoc.com or call him at 949-218-7942. If you email him, please put “Northwest Quadrant Alternative Investments” in the subject line.

Economic and Investment Highlights

Previous Weeks

FTX co-founder agreed to extradition to the U.S. and was transferred to U.S. custody. He was released on $250 million bail.

Individual investors have been doubling down on buying stocks, while professional investors have been selling.

Elon Musk put his continuation as head of Twitter to a vote of Twitter users. The majority of respondents voted for him to step down. Separately, Musk said that Twitter had been on track to lose $3 billion in cash flow per year before the layoffs he instituted. Twitter is on a major campaign to win back advertisers.

El Paso, Texas declared a state of emergency due to the influx of asylum seekers crossing the border illegally. Chief Justice Roberts issued an order temporarily keeping Title 42 in place, which bars asylum seekers from entering the U.S.

Biden’s advisers are making plans for a Biden re-election bid in 2024.

Hundreds of companies that went public when the IPO market was hot are now suffering huge reversals.

The January 6th Committee voted to refer Trump for criminal charges. It also released its final report.

China acknowledged the first Covid-19 deaths since the country ended its pandemic control policies.

The U.S. has sold 180 million barrels of crude from the U.S. Strategic Petroleum Reserve at prices well above the market price.

U.S. existing home sales fell in November for a tenth consecutive decline.

U.S. life expectance fell again last year to the lowest level since 1996. Covid-19 and opioid deaths were major contributors.

Short sellers in Tesla stock have made $15 billion in collective gains in 2022. Tesla offered significant discounts on its Model 3 and Model Y, raising concerns that sales may be softening.

Congress approved a $1.65 trillion spending bill, averting a government shutdown.

The U.S. economy showed signs of slowing late in the year, with consumer spending, business demand, and inflation all showing signs of easing.

The 10-year treasury yield ended the week at 3.746%. Gold closed at $1,795.90 for the week. Oil closed at $79.56 for the week.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The comments that follow are derived from the economic indicators referenced in the Resources section of this newsletter and other sources in this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) has been fluctuating within a narrow band. The current reading is -0.08 (12/17/22). This is a neutral indicator for the economy on a short-term basis.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.7 percent. This reading agrees with the ALS model assessment of a Neutral short-term economic environment.

The New York Fed Staff Nowcast: The uncertainty around the pandemic and the consequent volatility in the data have posed a number of challenges to the Nowcast model. Therefore, we have decided to suspend the publication of the Nowcast while we continue to work on methodological improvements to better address these challenges. (September 3, 2021)

The Chicago Fed National Activity Index (CFNAI) posted the following message: We are unable to access many of the data series used to construct the CFNAI. As a result, we will suspend the monthly release of the CFNAI until the new year [2023].

All told, these short-term economic indicators are a mixed analysis for the economy, at least on a short-term basis.

Expectations that stock prices will rise over the next six months is now at 20.3% in a recent AAII Sentiment Survey. The historical average is 38.0% for the survey. 27.4% of the investors in the survey described their short-term outlook as neutral and 52.3% were bearish. Please see the AAII Sentiment Survey for the complete results.

Quarterly Gross Output (GO) Data (as of 12/22/22): According to Dr. Mark Skousen, “While the lower growth rates suggest a slumping economy, both of these indicators [GO and GDP] are still in positive territory and do not indicate a full on recession just yet. However, while the adjusted real GO data shows no recession in 2022, it does suggest a pattern of an economy slowing down and headed perhaps into a recession in 2023, depending on how long the Federal Reserve imposes its tight-money policy.”

Advisor Perspectives publishes a monthly market valuation update.

Advisor Perspectives has market valuation and other useful and interesting investment information at this website.

Fourth Quarter 2022 Survey of Professional Forecasters

Forecasters Predict Lower Growth and Higher Unemployment Rate

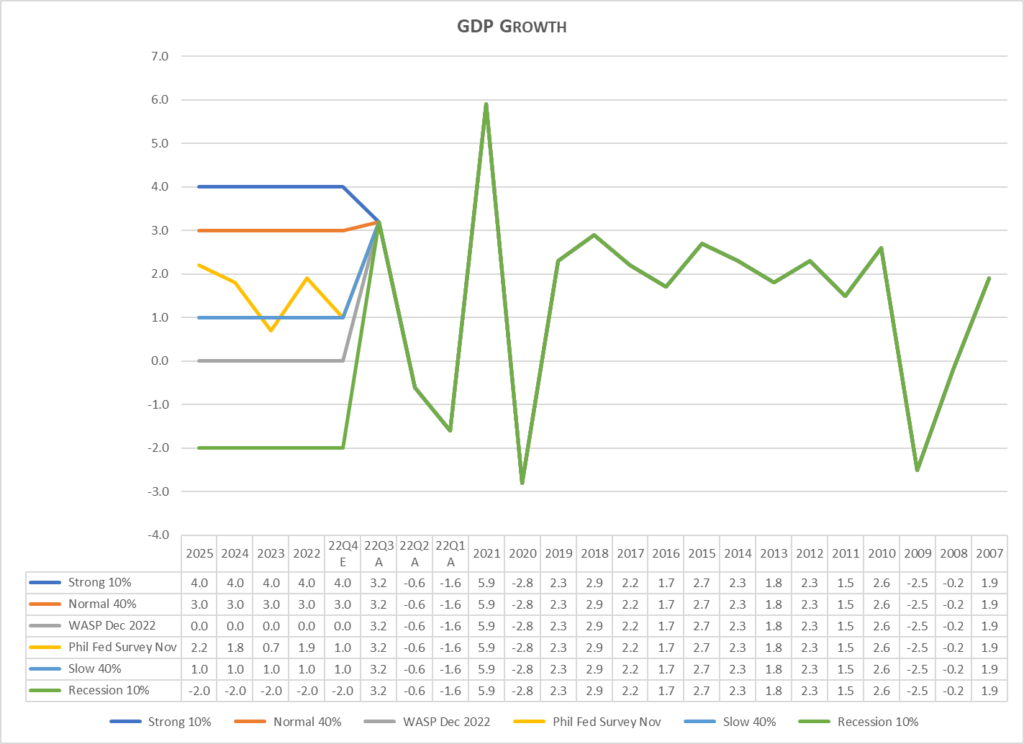

[Release Date: November 14, 2022] The outlook for the U.S. economy looks weaker now than it did three months ago, according to 38 forecasters surveyed by the Federal Reserve Bank of Philadelphia. The forecasters predict the economy will expand at an annual rate of 1.0 percent this quarter, down from the prediction of 1.2 percent in the last survey. Over the next three quarters, the panelists also see slower output growth than they predicted three months ago. On an annual-average over annual-average basis, the forecasters expect real GDP to increase 0.7 percent in 2023 and 1.8 percent in 2024. These annual projections are lower than the estimates in the previous survey.

A higher path for the unemployment rate accompanies the outlook for growth. On an annual-average basis, the forecasters expect the unemployment rate will increase from 3.7 percent in 2022 to 4.2 percent in 2023 and remain little changed over the following two years. The projections for 2023, 2024, and 2025 are 0.3 to 0.4 percentage point above those projections from the last survey.

On the employment front, the forecasters raised their current-quarter estimate for job growth to a monthly rate of 217,600 but revised downward their estimates for the next three quarters. The projections for the annual-average level of nonfarm payroll employment put job gains at a monthly rate of 492,800 in 2022 and 143,600 in 2023. (These annual-average projections are computed as the year-to-year change in the annual-average level of nonfarm payroll employment, converted to a monthly rate.)

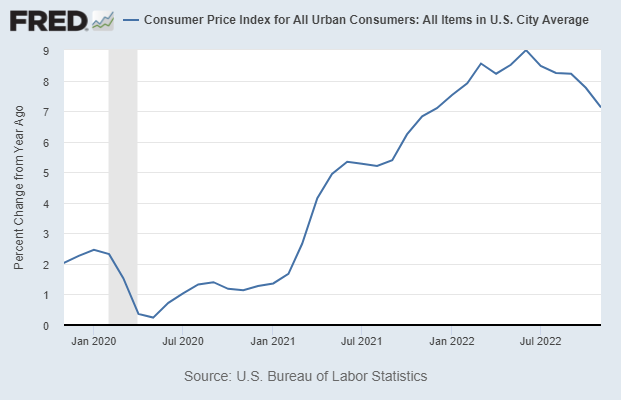

The forecasters expect current-quarter headline CPI inflation will average 5.4 percent at an annual rate, up from the prediction of 4.3 percent in the previous survey. Headline PCE inflation over the current quarter will also be higher at an annual rate of 4.6 percent, up from the last estimate of 3.7 percent.

Projections for headline and core CPI and PCE inflation at nearly all other forecast horizons have also been revised upward, compared with those of the previous survey.

Over the next 10 years, 2022 to 2031, the forecasters expect headline CPI inflation will be at an annual-average rate of 2.95 percent, slightly higher than their previous estimate. The corresponding estimate for 10-year annual-average PCE inflation is 2.58 percent, also slightly higher than the estimate of three months ago.

The forecasters see the risk of a downturn this quarter at 36.3 percent, up marginally from the previous survey. However, they have substantially raised their probability estimates of a negative quarter for the following three quarters and predict a near-50 percent chance of a contraction in real GDP in any of the four quarters in 2023.

The next survey will be released on February 10, 2023.

NABE Surveys

NABE Outlook Survey – December 2022

SUMMARY: “NABE survey participants continue to downgrade expectations for the U.S. economy, with projections of slower economic growth, higher inflation, and a weaker labor market,” said NABE President Julia Coronado, president and founder, MacroPolicy Perspectives LLC. “A majority of respondents believes there is more than a 50% probability that a recession will occur in 2023.”

“The more subdued outlook coincides with materially higher expectations for interest rates at the end of this year and next,” noted Dana M. Peterson, NABE Outlook Survey chair and chief economist, The Conference Board. “Panelists expect job growth will slow over the first three quarters of 2023 but remain positive.”

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Download

CONCLUSION

Important Note: While I don’t believe it is time to jump back into the stock market in a big way because of the market’s overvaluation and the high likelihood of a further deterioration in the U.S. economy, I have been advising in this Commentary and in my podcasts, Intrinsic Value Wealth Report Radio, that investors can continue building their investment portfolios by selecting individual securities that offer growth and value opportunities.

The Federal Reserve has been raising interest rates in order to tame rampant inflation. Fed Chairman Powell has repeatedly said that the Fed’s number one goal is to lower inflation, no matter what the cost. Raising interest rates is the main policy tool that the Fed has to combat inflation. Unfortunately, raising interest rates also eventually lowers economic activity and lowers employment. The Fed knows this and has said that lowering inflation is the top priority, no matter what harm comes to the economy. The Fed hopes for a so-called “soft-landing.” But soft landings are hard to engineer and have seldom been achieved. While it has taken a while to slow economic activity and lower employment, as the Fed had planned, the economy is starting to show signs of weakness. Furthermore, from our own economic model, and in our review of other economists models and forecasts, we, and a significant number of other economists, are forecasting a high probability of a recession going into 2023. You can read the Survey of Professional Forecasters and the National Association for Business Economists (NABE) reports above to see what these groups are saying.

Given these events and the gradually deteriorating situation, I would caution not to panic. The economy and the markets will get better. The situation is deteriorating – there is no doubt about that – but it will turn around. The real question is when will it turn around? No one knows that at the present time. But it will turn around.

For now, review your investment portfolios. It is highly likely that all or most of your stocks are down. You should not consider selling the bulk of your stocks – only consider selling companies that are not sound companies. But do recognize that as the economy deteriorates, even good companies will be affected.

For stock market value hunters, we believe it is still too early to jump back in. We will be closely monitoring the markets using the many tools and models that we have developed over the years to assess the economy and the markets. We will use our best judgement and thoughts to let you know when we believe things are turning around. The turnaround hasn’t happened yet.

We believe it is important to maintain a long-term view toward investing. But for now, just sit tight. Eventually, this means that you should continue building your investment portfolio using the Cassandra Stock Selection Model (note: we will be publishing an updated list of stocks to buy in the near future) to select individual securities that offer growth and value opportunities.

Chart for Review and Thought

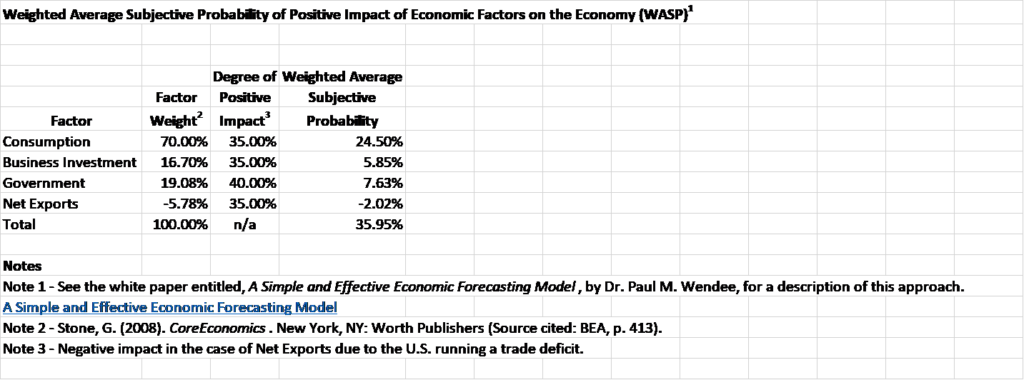

Simple and Effective Economic Forecasting Model

Note: We believe that a recession is quite likely in 2023. In the chart below, the bottom green line shows what a recession could look like. (Data and opinions as of 12/27/22)

Notes (GDP Growth Chart):

- See the July 8, 2019 Commentary for an introduction to this model.

- Actual numbers 2007 through Q3 2022; forecasted numbers thereafter.

- Normal GDP growth is typically in the 2% to 3% range.

- A recession is generally defined as two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

Thought for the Week

“The difference between stupidity and genius is that genius has its limits” ~ Albert Einstein

Announcements

The Intrinsic Value Wealth Report has an accompanying YouTube channel called Intrinsic Value Wealth Report TV. You can view the YouTube channel at Intrinsic Value Wealth Report TV.

The Intrinsic Value Wealth Report has an accompanying podcast called Intrinsic Value Wealth Report Radio. You can listen to the podcast at Intrinsic Value Wealth Report Radio.

Dr. Wendee attended the The National Due Diligence Alliance (TNDDA) investment banking conference, which was held November 11 – 13, 2022 at the Whitley Hotel in Atlanta. This is a conference held several times throughout the year for investment bankers and registered investment advisers to learn about new opportunities in the Alternative Investment asset classes.

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the near future to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers. We have been testing our crowdsourcing models with students and have been having good success and results.

Dr. Wendee has been researching and writing a new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics). The full paper on Intrinsinomics has been published and is available at this link.

Dr. Wendee presented a paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which was held in Ottawa, Canada in the Fall of 2019.

Dr. Wendee presented an updated paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference in October 2020 which was to have been held in San Francisco, California in November, but which was held virtually instead due to the Coronavirus.

Dr. Wendee presented an updated paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference in October 2021, which was which was held virtually and in person in Geneva, Switzerland. Dr. Wendee presented virtually.

Dr. Wendee presented the final paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference in October 2022, which was was held in Washington, DC.

Dr. Wendee has delivered several talks at the BrightTalk conferences. You can access his presentations here.

Dr. Wendee has presented at several conferences throughout the U.S. in the past several months, including the IMN and Opal conferences.

Dr. Wendee is working on a financial planning modeling program which will be available in the near future. The modeling program is designed to assist anyone in creating a financial plan and is customizable for each person’s unique financial planning goals. A working draft of the model is currently in beta test with students. Click this link, schematic, to go to the clickable document under the subheading Financial Planning Process (Draft) in the Intrinsic Value Wealth Report to see a draft of the schematic for the new financial planning process.

Dr. Wendee has been developing an econometric model specifically designed to monitor and forecast the global economy. This new econometric model is based on other econometric models that he has designed and has used for many years. You can find some of these earlier models in Book # 6 – Simple and Effective Economic Forecasting in the sister website to this website which is called the Intrinsic Value Wealth Report. The new econometric model has been constructed with some additional tools and methods that he has learned and some that he has developed over the last several years. He will be talking more about this new econometric model in this Commentary over the next few months. His comments and forecasts on the economy and the markets going forward will be based to a significant extent on this new model.

We have begun raising capital for our fund-of-funds investments, Northwest Quadrant Alternative Investments Opportunity Fund, LLC and Northwest Quadrant Alternative Investments Venture Fund, LLC. The Northwest Quadrant Alternative Investments Opportunity Fund, LLC engineers and constructs an investment vehicle consisting of Alternative Asset investments. The fund’s objective is to build a diversified portfolio of strong, solid, steady- performing assets, with highly qualified asset managers who have proven track records that meet our underwriting requirements. We believe that our Double Alpha Strategy of investing in these alternative investments can provide the mechanism for achieving high returns, while also providing appropriate and effective risk reduction. To learn more about the Northwest Quadrant Alternative Investments Opportunity Fund, LLC and to obtain an offering memorandum, please click Northwest Quadrant Alternative Investments Opportunity Fund. Northwest Quadrant Alternative Investments Venture Fund, LLC invests in early-stage companies that have higher return potential than other assets and asset classes. The overall returns for these early-stage venture capital types of investments can be in the 25% to 35% range. While these assets also have higher risk than other assets and asset classes, if managed properly, the overall risks of a portfolio can be reduced substantially. We believe that our Double Alpha Strategy of investing in these alternative investments can provide the mechanism for achieving high returns, while also providing appropriate and effective risk reduction. To learn more about the Northwest Quadrant Alternative Investments Venture Fund, LLC and to obtain an offering memorandum, please click Northwest Quadrant Alternative Investments Venture Fund.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine of the Best Ways to Build Wealth.