Too Early To Tell…

Bernie Sanders is ahead in the Democratic polls and the stock market is setting all-time highs. What is happening here? The simple answer is that it is too early to tell the outcome of the Democratic race – let alone the November elections. And at the time of this writing, Iowa still has not declared a winner! Stay tuned…at some point the stock market will start reacting. But for now, it is still too early to tell.

Economic and Investment Highlights

Last Week

The coronavirus continued to worsen and has closed China to the rest of the world.

The Kansas City Chiefs beat the San Francisco 49ers in Super Bowl LIV.

Oil prices slid to bear market territory over fears of a global economic slowdown due to the coronavirus.

Global manufacturing seems to be steadying after a long slowdown; but fresh concerns about its health have arisen due to the coronavirus.

Trump hailed the strong economy in his State of the Union address.

Trump was acquitted by the Senate in his impeachment trial.

The trade deficit narrowed in 2019 for the first time in six years.

Job gains again showed strength in January, with 225,000 jobs added and wages climbing 3.1% from a year earlier.

The Dow closed up 3.0% for the week. The S&P 500 closed up 3.17% and the Nasdaq closed up 4.0%. The 10-year treasury yield ended the week at 1.578%.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The comments that follow are derived from the economic indicators referenced in the Resources section of this newsletter and other sources in this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) has been trending up the last several weeks and is now comfortably above the zero line. This is a very positive indicator for the economy on a short-term basis.

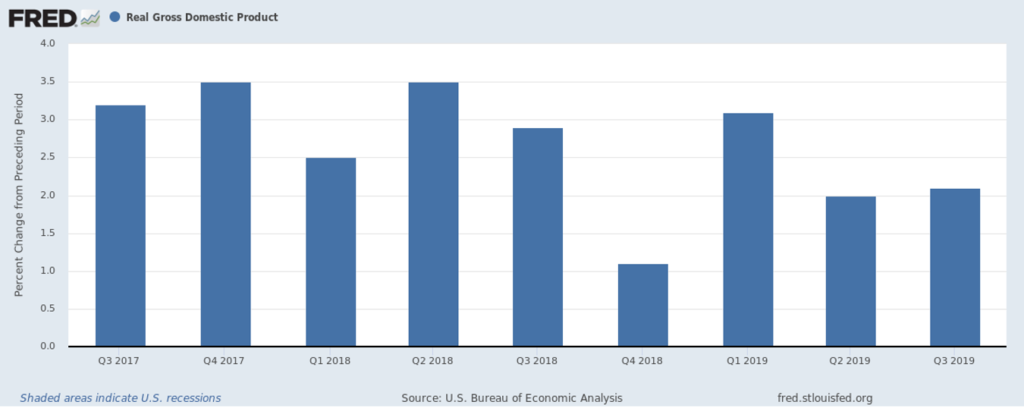

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.7 percent. This reading continues to support the ALS model assessment of an improving short-term economic environment.

The New York Fed Staff Nowcast stands at 1.7% for 2020:Q1.

The Chicago Fed National Activity Index (CFNAI) showed a decrease in economic activity in December. The Chicago Fed National Activity Index (CFNAI) was -0.35 in December, down from +0.41 in November.

All told, these short-term economic indicators are a neutral to positive analysis for the economy, at least on a short-term basis.

Expectations that stock prices will rise over the next six months is now at 33.9% in the latest AAII Sentiment Survey. The historical average is 38.0% for the survey. 30.9% of the investors in the survey described their short-term outlook as neutral and 35.2% were bearish. Please see the AAII Sentiment Survey for the complete results.

The latest Gross output (GO) reading suggests moderate economic growth as we enter 2020.

On a longer-term basis, the forecasters in the Philadelphia Fed’s Survey of Professional Forecasters (as of November 15, 2019) predict real GDP will grow at an annual rate of 1.7 percent for the fourth quarter of 2019, 1.9 percent for the first quarter of 2020, 1.7 percent in the second quarter of 2020, 1.7 percent in the third quarter of 2020, 1.9 percent in the fourth quarter of 2020. On an annual-average over annual-average basis, the forecasters predict real GDP to grow 2.3 percent in 2019, 1.8 percent in 2020, 2.0 percent in 2021 and 2.0 percent in 2022. The forecasters predict the unemployment rate will average 3.7 percent in 2019, 3.7 percent in 2020, 3.7 percent in 2021, and 3.9 percent in 2022.

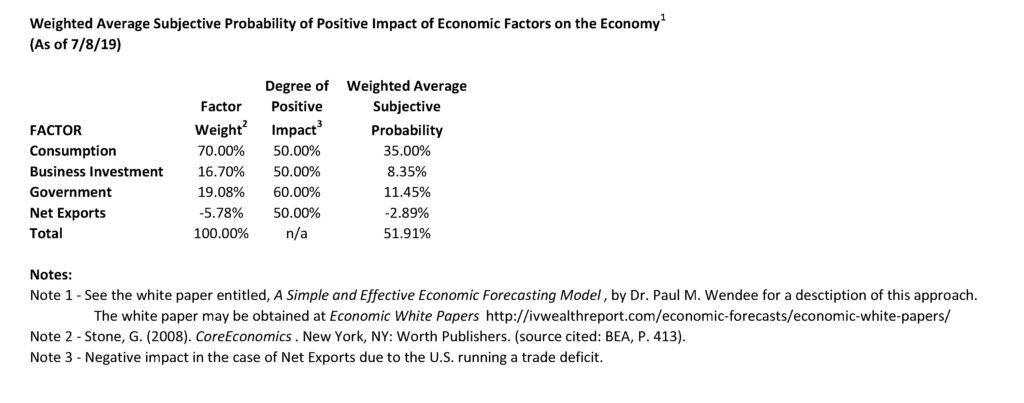

For a more in-depth review and analysis of the economy, please see our mini-book on economic analysis and forecasting entitled: Simple and Effective Economic Forecasting.

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Conclusion

We continue to believe the economy is in a stable but somewhat vulnerable state. Nonetheless, it has remained fairly strong. In fact, robust consumer spending and strong labor market conditions still give us confidence that the economy, now in its tenth year of expansion, can continue to grow. But we are cautious on this outlook! There are several reasons for our caution. U.S. business growth has been mixed. And global economic growth has been mixed as well. The new coronavirus is becoming a global economic threat, although it is still too early to tell how much of an effect it will ultimately have. Debt is at high levels for consumers, businesses, and government (at all levels). Finally, this is an election year that will likely have significant consequences either positively or negatively depending on the outcome of the elections. And of course, it is still too early to tell what the outcome of the elections will be.

The broad market remains overvalued, although the Dow Jones Industrial Average looks more fairly valued than the broad market. But that does not mean that a market correction is imminent. Markets can and do stay overvalued for long periods of time. As discussed above and in the Economic and Investment Highlights section of this Commentary, we believe the economy is in a stable but vulnerable state. If the economy remains strong, the markets will likely remain strong. If the economy deteriorates, the markets may well correct. There are other events that could trigger a market correction, of course, but economic conditions are the most likely and foreseeable events that could make that happen.

We believe it is important to maintain a long-term view toward investing. This means that you should continue building your investment portfolio using the Cassandra Stock Selection Model to select individual securities that offer growth and value opportunities.

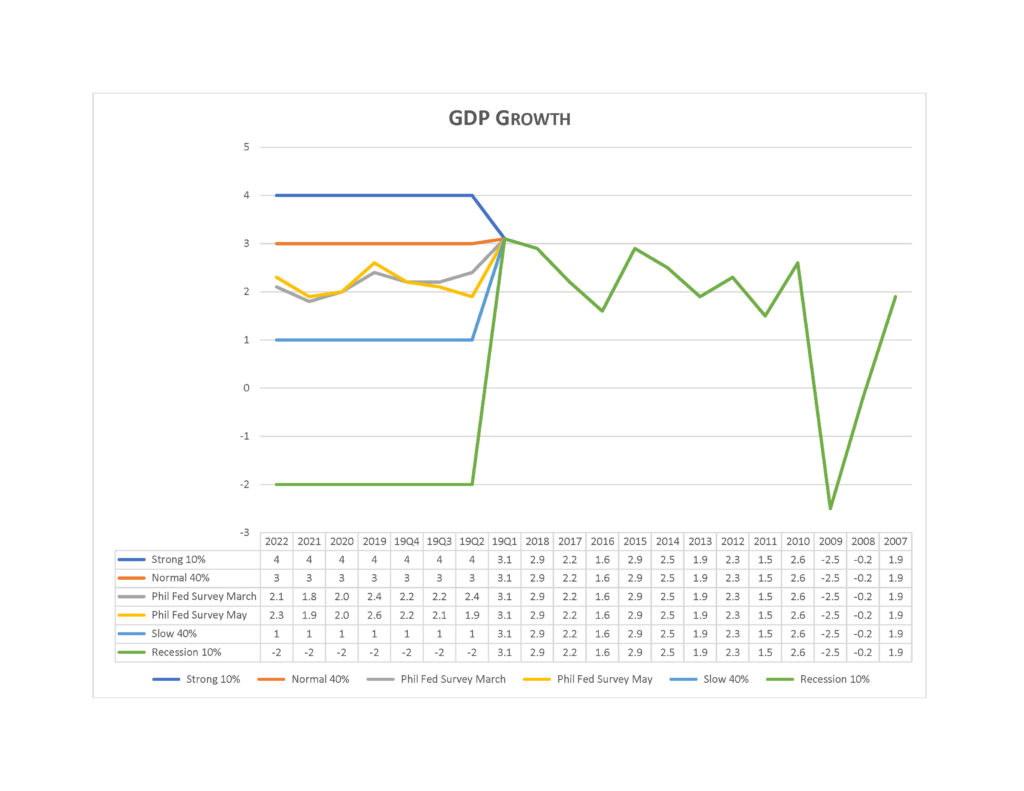

Chart for Review and Thought

Simple and Effective Economic Forecasting Model

Notes (GDP Growth Chart):

- See the July 8, 2019 Commentary for an introduction to this model.

- Actual numbers 2007 through Q1 2019; forecasted numbers thereafter.

- Normal GDP growth is typically in the 2% to 3% range.

- A recession is generally defined as two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP).

Announcements

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the next few weeks to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers.

Dr. Wendee has been researching and writing a new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics). The full paper on Intrinsinomics will be published in the near future.

Finance 3350: Personal Finance-Portfolio & Risk Management– Dr. Wendee started teaching Finance 3350 – Portfolio & Risk Management at California State University, Los Angeles (CSULA) starting January 2020. Dr. Wendee teaches courses in Management and Finance at CSULA.

Business 4970:Strategic Management – Dr. Wendee started teaching Business 4970:Strategic Management at California State University, Los Angeles (CSULA) starting January 2020. Dr. Wendee teaches courses in Management and Finance at CSULA.

Business 218 – Macroeconomics – Dr. Wendee started teaching Business 218 – Macroeconomics at California Baptist University (CBU) starting January 2020. Dr. Wendee teaches courses in Finance and Economics at CBU.

Dr. Wendee presented a paper on his new theory of economics known as, The Value Creation Theory of the Economy (also known as, Intrinsinomics), at the International Leadership Association’s annual global conference which was held in Ottawa, Canada last Fall.

Dr. Wendee is working on a financial planning modeling program which will be available in the near future. The modeling program is designed to assist anyone in creating a financial plan and is customizable for each person’s unique financial planning goals.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine Of The Best Ways To Build Wealth.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.