Some Of The Best Known Tech IPOs Sell For Less As Public Companies Then When They Were Private

What do Uber, Snap, Dropbox, and Cloudera all have in common? The price of their shares as public companies is lower than their price as private companies.

Venture capitalists (VCs) and private equity (PE) investors often view tech startups as industry disrupters, despite their often-heavy current losses. Venture capitalists and private equity firms fund the growth of these disrupters in the hope that they will make many multiples of return over their investment. These VC and PE firms are very patient, willing to wait for long periods of time to get these returns. Public investors, on the other hand, are more concerned about seeing revenues and profit in the foreseeable future. They are not willing to wait for years for the visions of the disrupters to play out.

Startups of U.S. companies that went public since 2015 have done well overall, though. Their public valuations are 90% on average higher than the valuations on the last private funding round. But these four companies that we have mentioned above have not lived up to expectations.

Economic and Investment Highlights

Last Week

Spending on factories, equipment, and other capital goods slowed in the first quarter.

Fed Chairman Powell warned again of the risks of rising corporate debt. We have been citing this concern for quite some time (see for example our Economic and Investment Review in the Winter edition of this newsletter).

Economic distortions in Europe prevail due to the widespread and continuing use of negative interest rates. Negative interest rates have been a policy solution to jump-start European economies for the past five years; but European central banks that implemented these policy initiatives have so far been unable to return to a positive rate environment.

Retail sales at several major chains slowed in the latest quarter.

U.S. new and existing home sales fell in April, continuing a softening in the U.S. housing sector.

Durable goods orders fell 2.1% in April.

One-quarter of working Americans have no retirement savings.

Prime Minister Theresa May is resigning as Britain’s prime minister after failing to win support for her Brexit deal.

The Dow Jones Industrial Average declined for the fifth consecutive week. The S&P 500 declined 1.2% for the week.

The Week Ahead

This link takes you to Econoday’s Economic Calendar and Economic Events and Analysis which shows the upcoming economic reporting events scheduled in the week and months ahead.

Summary

Note: The comments that follow are derived from the economic indicators referenced in the Resources section and other sources at the end of this report.

The Aruoba-Diebold-Scotti Business Conditions Index (ALS) has been trending up the last several weeks and is now very close to the zero line. The ALS Index advanced slightly again this past week. This is a very positive indicator for the economy on a short-term basis.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.3 percent on May 24, up from 1.2 percent on May 16. This slight adjustment continues to support the ALS model assessment of an improving short-term economic environment.

The New York Fed Staff Nowcast stands at 1.4% for 2019:Q2. The Chicago Fed National Activity Index (CFNAI) showed a decline in economic activity in April.

The Chicago Fed National Activity Index (CFNAI) was –0.45 in April, down from +0.05 in March.

All told, these short-term economic indicators are a positive analysis for the economy, at least on a short-term basis. However, all but the ALS showed a slight decline in the past week.

Expectations that stock prices will rise over the next six months declined 5.1 percentage points to 24.7%, an unusually low level, in the latest AAII Sentiment Survey. The historical average is 38.5% for the survey. Please see the AAII Sentiment Survey for the complete results.

The latest Gross output (GO) reading suggests slow economic growth as we enter 2019.

On a longer-term basis, the forecasters in the Philadelphia Fed’s Survey of Professional Forecasters (as of May 10, 2019) predict real GDP will grow at an annual rate of 1.9 percent this quarter and 2.1 percent next quarter. On an annual-average over annual-average basis, the forecasters predict real GDP to grow 2.6 percent in 2019, 2.0 percent in 2020, 1.9 percent in 2021 and 2.3 percent in 2022. The forecasters predict the unemployment rate will average 3.7 percent in 2019, 3.6 percent in 2020, 3.7 percent in 2021, and 3.9 percent in 2022.

For a more in-depth review and analysis of the economy, please see our mini-book on economic analysis and forecasting entitled: Simple and Effective Economic Forecasting.

Stock Market Valuations

Our estimates of the market valuations for two stock market indices, the Dow Jones Industrial Average (DJIA) and the Standard & Poor’s 500 (S&P 500), can be found in the file below:

Conclusion

We continue believe the economy is in a stable but somewhat vulnerable state. Nonetheless, it has remained fairly strong. In fact, the extremely strong first quarter GDP showing and the strong labor market conditions give us more confidence that the economy, now in its tenth year of expansion, can continue to grow. Please see our complete Economic and Investment Review in the Winter 2019 quarterly issue of the Intrinsic Value Wealth Report Newsletter.

Even with the further pullback in the market this past week, the broad market remains overvalued, although the Dow Jones Industrial Average looks more fairly valued than the broad market. But that does not mean that a market correction is imminent. Markets can and do stay overvalued for long periods of time. As discussed above in the Economic and Investment Highlights section of this Commentary, we believe the economy is in a stable but vulnerable state. If the economy remains strong, the markets will likely remain strong. If the economy deteriorates, the markets may well correct. There are other events that could trigger a market correction, of course, but economic conditions are the most likely and foreseeable events that could make that happen.

We believe it is important to maintain a long-term view toward investing. This means that you should continue building your investment portfolio using the Cassandra Stock Selection Model to select individual securities that offer growth and value opportunities.

Chart for Review and Thought

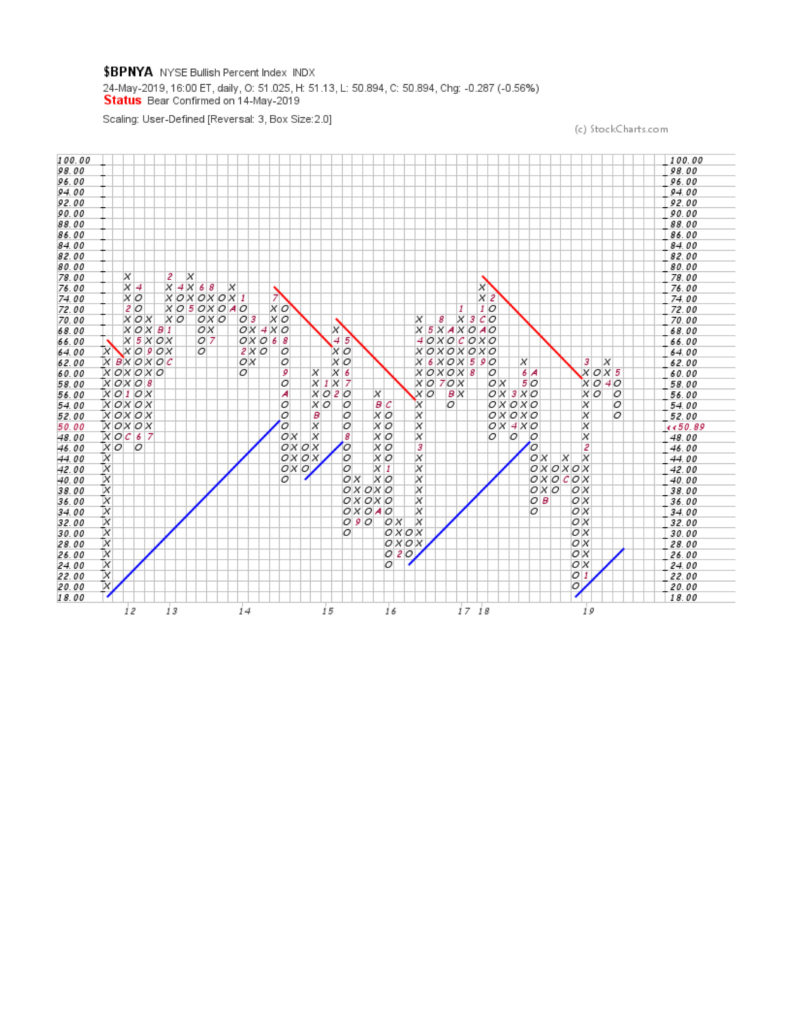

The New York Stock Exchange Bullish Percent Index Went Into Bear Confirmed Status on May 14, 2019

Announcements

We have been researching the use of crowdsourcing for investment ideas. We will be sending a survey out in the next few weeks to get your input on the economy and the markets; and to get any investment ideas that you would like to share. We will compile this input and distribute the results to you and our other subscribers.

Dr. Wendee will be speaking at the Las Vegas Investment Club on June 24th. He will be speaking on the topic of his popular Forbes article, Nine of the Best Ways to Build Wealth. Please contact Mike Lathigee at mike@mikelathigee.com if you would like to attend.

Dr. Wendee will be speaking at FreedomFest during its annual conference in Las Vegas, July 17 – 20, 2019.

Dr. Wendee will be a judge at the FundingPost June PitchFest Event on June 11, 2019 in San Diego. Click on this link for details on the event:

https://www.fundingpost.com/event/reg1.asp?event=433

Business 539 – Financial Management – On May 9, 2019, Dr. Wendee started teachingBusiness 539 – Financial Management at California Baptist University (CBU). Dr. Wendee teaches courses in Finance and Economics at CBU.

Management 3080 – Business Responsibility in Society – Dr. Wendee will be teaching Management 3080 – Business Responsibility in Society at California State University, Los Angeles (CSULA) starting May 29, 2019. Dr. Wendee teaches courses in Management at CSULA.

Dr. Wendee will be presenting a paper on enterprise value creation at the International Leadership Association’s annual global conference which is being held in Ottawa, Canada this Fall.

Intrinsic Value Wealth Creation pyramid

We always conclude our commentary with a discussion of the Intrinsic Value Wealth Creation Pyramid. The Intrinsic Value Wealth Creation Pyramid is designed to show some of the major categories for building wealth. It is the result of many years of study of the wealth building process; experience working with clients who have built considerable wealth; and my own personal experience building wealth. Newsletter subscribers should consult the Intrinsic Value Wealth Creation Pyramid as one of many useful investment tools while considering their investment plans.

The chart in this section is an expanded version of the Intrinsic Value Wealth Creation Pyramid Chart referenced in the Forbes.com article entitled, Nine Of The Best Ways To Build Wealth.

RESOURCES

See our Resources section for links to economic and other resources used in the preparation of this Commentary.